Accurate QuickBooks Contractor Reports You Need To Navigate The Business Cycle!

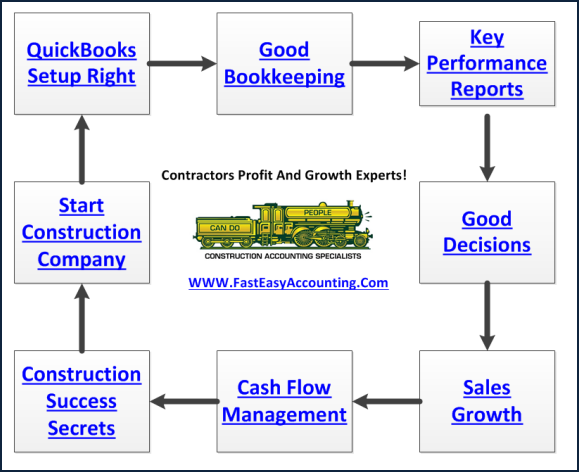

Accurate QuickBooks contractor reports are what profitable contractors use to help them steer their construction company through the rolling waves of the business cycle like a large ocean liner on the high sea.

Today more than ever owning and operating your construction company is a rough and tumble game because everyone has access to so much information and now more than ever you need clear and concise actionable information to survive and thrive.

The same QuickBooks contractor reports the profitable contractors use are available to every all four types of contractors from the one-person “Dog and Pickup Truck” to the "Enterprise" level contractor. For more on this click here.

Incidentally the size of your construction company is not as important as how much money you earn from it. Our internal research has shown that a properly run construction company with annual sales of $250,000 to $5,000,000 can generate more hard dollars for the owners and employees than a company with annual sales between $5,000,000 and $20,000,000. It has to do with understanding the Expansion Isoquant and knowing the difference between maximize and optimize. For more on this click here.

The QuickBooks reports number that are available number in the thousands and with any one of the hundreds of add-on software you could generate millions reports. If you are a construction accountant like me you would love it. I love learning about construction reports and I invest a certain amount of time testing and reviewing add-on software to find more BBCR (Bigger Better Construction Reports). That's all fine and nice; however you want to know:

Which Reports Will Help Me Increase Sales And Profits?

The reports that stand the test of time are:

-

The Five Key Performance Reports, (KPI) Reports. Cash Report, Receivables, Parables, Profit and Loss and Balance Sheet. For more on this click here

-

Job Cost Reports, Job Profitability Reports. For more on this click here

What Makes QuickBooks Contractor Reports Valuable?

Understanding and using the information they provide to make strategic and tactical decisions to increase sales and profits in your construction company. What if I told you there is buried treasure in your backyard and all you need is a treasure map to find it and dig it up, would you be interested? Of course you are!

The Map Is Hidden Inside Your QuickBooks Contractor Reports And To Get Them You Need The Decoder Key!

QuickBooks Setup Is The Decoder Key

If your QuickBooks setup was done by a QuickBooks Expert in construction accounting and maintained correctly you are riding high and living well! If not, we can fix just about any QuickBooks setup by performing a QuickBooks cleanup and importing all of the transactions. The Chart of Accounts is the foundation and if your Chart of Accounts is not setup right you will not have anywhere to put the transactions.

The Short List Of Essentials In Our QuickBooks Setup

-

User Permissions

-

Company Information Window

-

Chart of Accounts Direct Construction Costs

-

Chart of Accounts Indirect Construction Costs

-

Chart of Accounts Work-In-Progress For Land Developers

-

Chart of Accounts Work-In-Progress For Land Development Into Lots

-

Chart of Accounts Work-In-Progress For Spec Builders

-

Chart of Accounts Work-In-Progress For Spec Home Into Rentals

-

Chart of Accounts Over Billings For Earned Value Reports

-

Chart of Accounts Under Billings For Earned Value Reports

-

Chart of Accounts Retention From Your Customers

-

Chart of Accounts Retention For Your Subcontractors

-

Chart of Accounts Job Deposits From Your Customers

-

Chart of Accounts Indirect Construction Costs

-

Chart of Accounts Prepaid Expenses

-

Chart of Accounts Job Deposits

-

Chart of Accounts Fixed Assets

-

Chart of Accounts Depreciation

-

Chart of Accounts Intercompany Transfers

-

Chart of Accounts Payroll

-

Chart of Accounts Payroll Taxes

-

Chart of Accounts Payroll Tax Liabilities

-

Chart of Accounts Customer Discounts

-

Chart of Accounts Bad Debts

-

Chart of Accounts Customer Checks Returned From Bank

-

Chart of Accounts Employee Loans And Repayments

-

Chart of Accounts Jobsite Costs

-

Chart of Accounts Warranty Work

-

Chart of Accounts Sales Tax Errors

-

Chart of Accounts Mobilization

-

Chart of Accounts De-Mobilization

-

Chart of Accounts Leases

-

Chart of Accounts Purchases

-

Chart of Accounts Marketing

-

Chart of Accounts Advertising

-

Chart of Accounts Owner Loans And Repayments

-

Chart of Accounts Special Accounts For Sole Proprietors

-

Chart of Accounts Special Accounts For LLC Corporations

-

Chart of Accounts Special Accounts For Sub-S Corporations

-

Chart of Accounts Special Accounts For Partnerships

-

Chart of Accounts Special Accounts For LLP Limited Partnerships

-

Chart of Accounts Special Accounts Flipper Houses

-

Chart of Accounts Credit Cards

-

Chart of Accounts Lines Of Credit

-

Chart of Accounts Short Term Loans

-

Chart of Accounts Long Term Loans

-

Chart of Accounts Spec House Construction Loans

-

Chart of Accounts Land Development Construction Loans

-

Chart of Accounts General And Administrative

-

Chart of Accounts Occupancy Costs

-

Chart of Accounts Triple Net Leasing Costs

-

Chart of Accounts Technology

-

Chart of Accounts Professional Fees

-

Chart of Accounts Taxes

-

Chart of Accounts Licenses

-

Chart of Accounts Insurance Builders Risk.

-

Chart of Accounts Insurance Vehicles

-

Chart of Accounts Insurance Liability

-

Chart of Accounts Insurance Health And Dental

-

Chart of Accounts Financing Costs

-

Chart of Accounts Interest Earned

-

Chart of Accounts Gain And Loss On Fixed Assets

-

Chart of Accounts Estimates

-

Chart of Accounts Sales Orders

-

Chart of Accounts Purchase Orders

-

Item List Direct Construction Costs

-

Item List Indirect Construction Costs

-

Item List Construction Job Deposit

-

Item List Construction Labor Costs

-

Item List Construction Material Costs

-

Item List Construction Other Costs

-

Item List Construction Subcontractors Costs

-

Item List CSI Codes For Commercial Construction

-

Item List Bid Bond Deposits

-

Item List Sales Tax For Cities (Updated When It Changes)

-

Item List Sales Tax For Counties (Updated When It Changes)

-

Item List Sales Tax For State (Updated When It Changes)

-

Item List Land Developers Direct Costs

-

Item List Land Developers Indirect Costs

-

Item List Spec Home Builders Direct Costs

-

Item List Spec Home Builders Indirect Costs

-

Item List Retention Held By Customers

-

Item List Retention Holding For Subcontractors

-

Item List Work-In-Progress Costs For Land Developers

-

Item List Work-In-Progress Transfer Costs For Land Developers

-

Item List HUD-1 Statement Transfer Costs For Land Developers

-

Item List Work-In-Progress Costs For Spec Home Builders

-

Item List Work-In-Progress Transfer Costs For Spec Home Builders

-

Item List HUD-1 Statement Transfer Costs For Spec Home Builders

-

Item List Work-In-Process Transfer Costs For Spec Home Builders

-

Retention Tracking For Your Customers And Trade / Subcontractors

-

Payroll For Your Employees

-

Payroll Sick Days

-

Payroll Vacation Days

-

Payroll Loans Setup And Tracking

-

Payroll Loan Repayment Setup And Tracking

-

Payroll Reimbursement Setup And Tracking

-

Payroll Garnishment Setup And Tracking

-

Payroll Child Support Setup And Tracking

-

Payroll Tax Table

-

Owners Time To Job For Job Costing Without Affecting Financial Report

-

Preferences In 23 Categories Each One With Multiple Decision Points

-

Price Level List

-

Billing Rate List

-

Sales Tax Code List

-

Other Names List

-

Customer Profile List

-

Vendor Profile List

-

Templates List

-

Memorized Transaction List

-

Memorized Reports List

Our process for QuickBooks setup of a new client is a whole lot longer than what I am showing here and for some of you this was TMI (Too Much Information).

Our construction company clients offer a lot of feedback regarding what they would like their QuickBooks contractor to do and we listen to each and every request and look for ways to add those enhancements and more.

On average the QuickBooks setup template will have 50 enhancements a year. We test them on our server and when they are proven to work we manually update each and every client that has their QuickBooks contractor file on our server. And then we test each update on every client QuickBooks contractor file to make certain it will work.

Most of the time our clients do not even know when a template update happened, they just know it works a little bit better and something that was a problem no longer is a problem.

The one BIG PROBLEM we caution you about is be careful when you tell another contractor about all the reports and how Fast And Easy your QuickBooks contractor works because in most cases they will not believe you. It is the difference between QuickBooks setup the easy way and QuickBooks setup the hard way!

QuickBooks Expert Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.