Commercial Tenant Improvement Contractors Have Unique Bookkeeping Needs:

-

Not Just Any Bookkeeper Will Do - Too often Commercial Tenant Improvement Contractors hire a bookkeeper and end up with the wrong bookkeeper if they believe all bookkeepers are the same. Nothing is further from the truth. You would never hire a construction worker with a background in residential roofing to be on your night crew doing a restaurant build out because they are trained to work outside in the sunshine and not be bothered with other trades. Typically they work in the daytime and sleep at night.

-

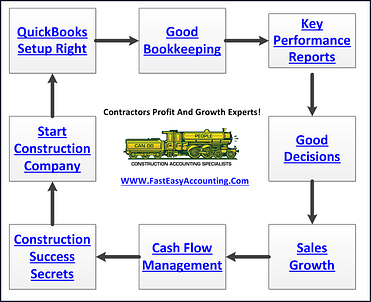

QuickBooks Setup - And choosing the correct QuickBooks Version is the most critical part of all because it is the foundation upon which your entire financial system is built. Put the wrong foundation under your business and it will not matter who is doing the bookkeeping because it will always be a mess and you will never get the reports you really need in order to operate and grow your business profitably. Your Board of Advisors and especially your banker will be unhappy; however, they may not say it outright, just that your loans, lines of credit and referral opportunities may be limited.

-

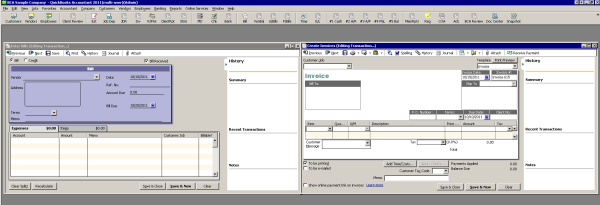

Commercial Tenant Improvement Contractors - Need people trained in construction bookkeeping who understand how to put together a Pay Application (also known as a G702-G703 type of Payment Application) with multiple deposits, change orders, percentage or completions, retention and done in such a way that it can carry the balances forward to future Pay Applications (also known as a G702-G703 type of Payment Application) correctly. Most regular bookkeepers have no idea what that means let alone put it together and track it properly in QuickBooks. The difference between a Professional Bookkeeping Service and a Cheap Bookkeeper can cost commercial tenant improvement contractors tens of thousands of dollars or more a year or more on your bottom line profit.

-

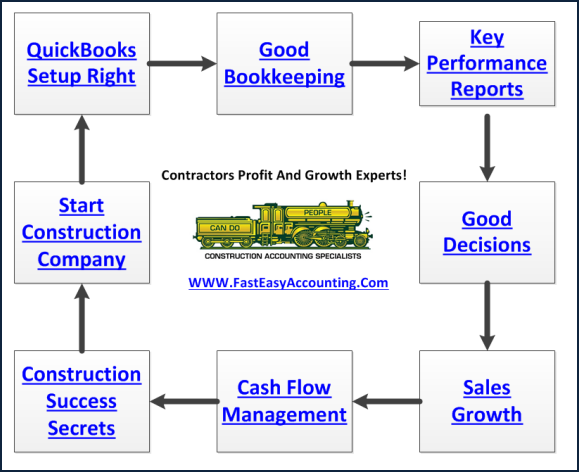

Many Bookkeepers Have Been Stumped - Trying to force QuickBooks to do the accounting for commercial tenant improvement contractors and I understand and empathize with their plight. We spent years and thousands of dollars developing a process that works with QuickBooks. And every year we continually innovate and add new features and benefits to it! We know what to do!

-

Commercial Tenant Improvement Contractors - Who also do some remodel work, service work as a method of marketing, buy houses for rental inventory and buy houses to fix up and sell, house flippers, create special problems for regular bookkeepers. There is only one method that works well and we have we have a system that allows all the bookkeeping to be done inside QuickBooks and it can save you time, manage cash flow and save money on taxes. We know what to do!

-

Complex Custom Pay Applications - Using your forms or ours with milestones, multiple deposits, payments, changes, payment history and running totals is something we can prepare for you and send them to you as often as you need them.

What You Can Expect From Our Commercial Tenant Improvement Contractor Bookkeeping Services:

-

Professional Bookkeepers with over 10,000 hours of practice

-

Retention Tracking System

-

Optional scanner for sending paperwork to us with the touch of a button

-

Five Key Performance Indicator Reports for monitoring your business

-

Business Coaching - Someone who understands your business to talk with

-

Access to Meeting Space 24/7/365 - For training, meeting clients and vendors and quiet work place

-

Cloud based document storage

In The Long Run We Are Less Expensive Cheap Bookkeeper

And We Offer Cloud Based Desktop QuickBooks

-

Fully functioning QuickBooks desktop version

-

Export to Excel and Word which is part of the service

-

Print anything directly from QuickBooks, Word or Excel on your own printer

QuickBooks Expert Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.