Specialists Combine Synergy To Guide Construction Companies

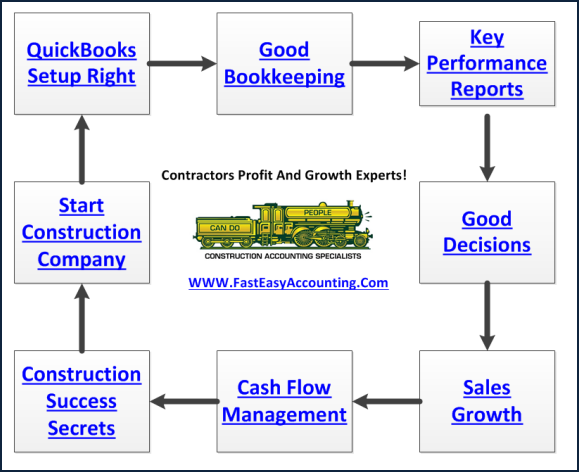

Success In Construction - Now more than ever means tapping into the resources of many specialists and not relying on One-Size-Fits-All.

Construction Accounting - Is our special expertise which means all of my writing is addressed to members of the construction industry and how we can help them with QuickBooks Setup, QuickBooks Clean-Up and Cloud Based Online Bookkeeping Services.

Contractors Stepping Out - Starting or growing a construction business can be scary and especially if you read about how many businesses, especially contractors fail in the first few years. So we tend to mentor contractors in the early phases until they get the financial foundation in place and start making money.

Board of Advisors - Is a well-kept secret we use to help our contractor clients become successful. Large companies have a paid Board of Directors and depending on the charter they may have power to hire, fire and change direction of the company with or without the founder's agreement. A Board of Advisors has no power and acts independent of the contractor. Their job is to advise, mentor and council only when the contractor asks them too.

This Is Where We Transition - Contractors into being supported by winning teams; but only when they are comfortable and confident and not before. No matter what we are always there to provide support and guidance and treat them with the respect they deserve.

#1 Commercial Banker - Someone to help you manage cash flow and put your cash to work earning interest with sweep accounts and other banking tools. They are excellent at reviewing your Key Performance Indicators and advising on profit and growth opportunities.

#2 Construction Accountant- Get a good construction bookkeeping and accounting firm and outsource as much bookkeeping, payroll processing, complex invoicing and monthly and quarterly tax reports as you can afford. It will free up time to do what you do best and the books will be kept in order. Choose someone that specializes in your industry because the days of the one-size-fits-all accounting practice has gone the way of the dinosaurs.

#3 Tax Preparer - Depending on the size and complexities of your construction company you may need a C.P.A. and if you have one now keep them. This is one of the first people we refer our clients too. Most professional contractors need the advice and protection of a C.P.A. to prepare their business and personal annual income tax returns and certify business financial statements as needed for bonding companies and lenders. We really appreciate working with C.P.A.'s who have an understanding of construction accounting including Work-In-Progress, Retention, Over and Under Billings and a whole bunch of other items that are specific to construction. What we do not appreciate is a C.P.A. attempting to mimic our expertise in construction accounting. And the reverse is true; we do not attempt to stay current on tax code and pretend to have expertise in preparing annual tax returns.

#4 Commercial Attorney - Is extremely important. Two kinds of contractors in this area; ones who have a commercial attorney and ones who will get one after having locked horns with somebody else's commercial attorney. A good commercial attorney will draw up employment agreements, construction contracts, review insurance policies and more. A qualified commercial attorney is worth every dime they charge.

#5 Financial Planner

Eventually You Will Want - To leave your business and pursue other interests so plan ahead now. You could start with Quicken software and play around with it. You can learn a lot about investing and run some scenarios that will show you how much income you will need to retire and develop an action plan.

Once you have some basic knowledge get a Certified Financial Planner. If you do not have a lot of money to ask your commercial banker to recommend someone at the bank and eventually when your reserves build up get a Certified Financial Planner.

To Summarize:

Construction accounting is a very small part of the accounting world and a lot of good people with the best intentions have and continue to do a lot of damage to contractors accounting systems. That is where I meant for the Red Flags to address.

A big part of what we do setting up QuickBooks for construction companies and in some cases we take over the bookkeeping function. We work closely with C.P.A. firms, banks and lenders so we have a good idea of what financial reports C.P.A. firms need to prepare the annual income tax returns.

We have developed custom QuickBooks reports to meet the needs of contractors to help them operate and grow their businesses effectively and C.P.A. firms, bank and lenders to be able to file the taxes easier and make lending decisions.

We have used a C.P.A. to prepare our business and personal returns since the early 1970’s and I cannot say enough good things about them. Our first C.P.A. passed away, the second one retired and we are holding onto the one we are using now for dear life.

We know what to look for in a C.P.A. and like you once we find one we stay until the pass away or go out of business.

I am very passionate about helping contractors achieve their definition of success having been involved with construction since working in the family contracting business after school growing up, owning and operating several construction businesses to now being a construction accountant.

Sometimes passion is a good thing and sometimes I need to remind myself to tone it down a bit.

QuickBooks Expert Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional and Construction Accountant and Intuit ProAdvisor. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional and Construction Accountant and Intuit ProAdvisor. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.