Effective December 11, 2011 - Washington State passed a Bill, SHB 2169, modifying the uniform unclaimed property act and empowering the Washington State Department of Revenue to act as the collection agency.

Construction Companies - Doing business in Washington State are getting letters from Washington State Department of Revenue regarding Unclaimed Property Report.

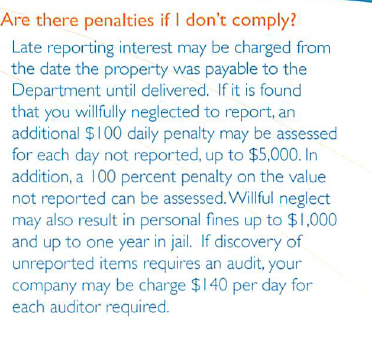

If Your Company Received - A letter you need take it very seriously and act quickly because the fines and penalties could be harsh and painful as shown in the excerpt from the "Quick Start Reporting Guide" below:

It Is Important - That you do not delay in getting this report filed

You Can Do-It-Yourself - Report Unclaimed Property Website Link

We Can Help You - Call Sharie 206-361-3950 or e mail sharie@fasteasyaccounting.com

Be In Business - For yourself; however, not by yourself, let us help!

The Video Below Is About Sales Tax In Washington State

QuickBooks Expert Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.