Sharie DeHart

Recent Posts

Contractor Clients' Communication Process For Better Bookkeeping

Posted by Sharie DeHart on Tue, Aug 06, 2019

Topics: Communication Skills For Better Accounting Results, Construction Marketing, Clients

Construction Company Marketing - Leads, Customers, And Clients

Posted by Sharie DeHart on Fri, Jul 26, 2019

Topics: Construction Marketing, Customers Vs. Clients, Clients, Inbound Marketing For Contractors, offline marketing for contractors

Topics: Time Cards, Contractors Bookkeeping Paperwork, Time Card Issues, QuickBooks For Contractors, Construction Bookkeeping, Painless Paperless Contractor Bookkeeping Services

Establishing Your General Contracting Business - TIPS On Starting It Right

Posted by Sharie DeHart on Fri, Jun 07, 2019

Running a business for general contractors like you is an overwhelming yet fulfilling task because there are so many things only the company owner can and should do. In most cases, when the owner's spouse contacts us, it is because they are trying to help with the business, but they know they need outside assistance, so there is more quality time with the family.

Most contractors, and small business owners, in general, haven’t realized that what you don’t know can keep you up at night. Instead of focusing your efforts in maintaining your relationship with your past clients and building a new one, you were up wondering whether you’re making or losing money. Today more than ever, it is necessary to have a properly set-up accounting and bookkeeping file and maintain it. Someone with the knowledge and training combined with an understanding of construction to Set-Up, Clean-Up, Tidy-Up, and manage your bookkeeping system.

Topics: Contractors Bookkeeping Paperwork, QuickBooks For Contractors, Construction Bookkeeping, QuickBooks Setup Do It Yourself, QuickBooks Construction Accounting, Assisted Do-It-Yourself Contractor Bookkeeping, Painless Paperless Contractor Bookkeeping Services

In Construction, hiring Independent Contractors can get very expensive, very fast!

The Internal Revenue has a defined set of rules on what is the difference between an "Independent Contractor" and "Employee". With all the documentation in place, a person could still be classified in the eyes of the Internal Revenue Service as an "Employee."

When you hire 1099 contractors

You need to know that their state contractor's license, bond, and insurance are active. During audits, state agencies are now looking to check the bond and insurance. Anytime a contractor's license is suspended, the State may reclassify that person as an employee on your job.

Because all fifty states are working with other agencies looking to be sure employee rights are covered, and the state, local and federal payroll taxes are paid. As an employer among your responsibilities are these:

-

Pay workers’ compensation

-

Meet wage and hour requirements

-

Pay unemployment tax

-

Maintain a safe workplace

Topics: Contractors Bookkeeping Paperwork, Subcontractor 1099, QuickBooks For Contractors, Construction Bookkeeping, QuickBooks Construction Accounting, Taxes

Bookkeeping And Accounting Solutions For The Busy Contractor

Posted by Sharie DeHart on Fri, May 17, 2019

The calls, emails, messages, and walk-ins that our company deal with every day come from construction contractors, spouses or significant other, construction bookkeepers, advisors, students, and financial planners among others. I do my best to offer support even if it does not lead to an immediate request for our services.

The pressures of running a construction company are tremendous. Incoming money is usually unknown, but expenses and bills are due now. You are not alone; many contractors feel the same way. Owning a construction company is so much different from just working for another construction contractor, and in most cases, new contractors had no idea what is involved in the business end of the operation before they started.

Topics: Contractors Bookkeeping Paperwork, QuickBooks For Contractors, Construction Bookkeeping, QuickBooks Setup Do It Yourself, QuickBooks Construction Accounting, Assisted Do-It-Yourself Contractor Bookkeeping, Painless Paperless Contractor Bookkeeping Services

Paperwork Processes Particular To Construction Contractors

Posted by Sharie DeHart on Tue, May 07, 2019

One of the biggest struggles contracting business owners deal with is the overwhelming amount of paper they have to organize as part of their everyday tasks. Invoices, receipts, bills, contracts, client records, pay applications, insurances, licenses - are just a few that seem to be never-ending "etc". Keeping important documents is necessary. Most contractors go from one extreme to the other. One extreme saves everything for decades, and the other tosses everything out.

What to save? What to toss out? At Fast Easy Accounting, we no longer need to print and save every document in file folders and keep adding new file cabinets. Our paperwork processes ensure your happiness and peace of mind knowing that your papers can be retrieved electronically at any time in the future.

Topics: Contractors Bookkeeping Paperwork, QuickBooks For Contractors, Construction Bookkeeping, QuickBooks Setup Do It Yourself, QuickBooks Construction Accounting, Assisted Do-It-Yourself Contractor Bookkeeping, Painless Paperless Contractor Bookkeeping Services

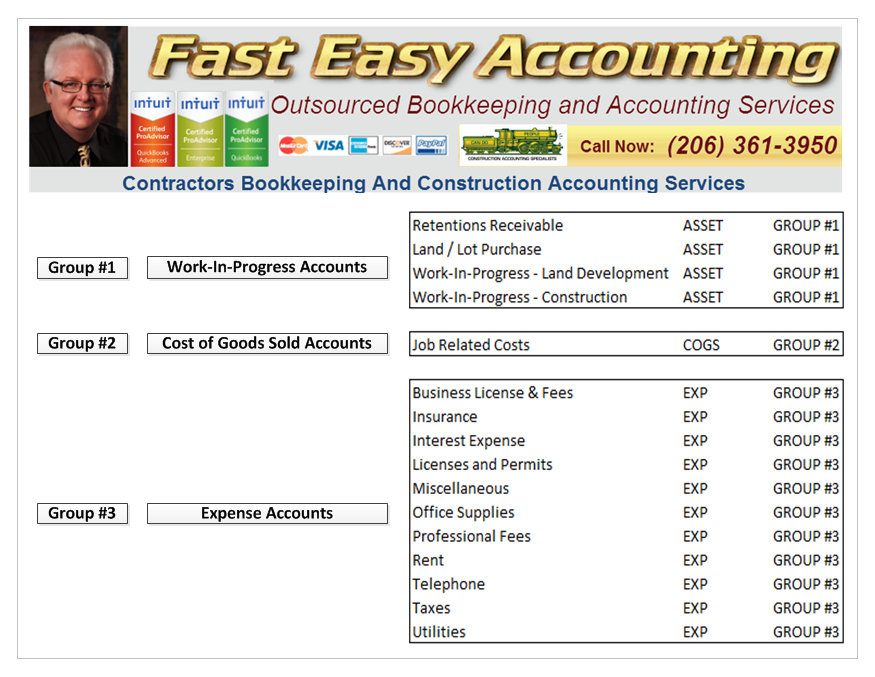

Take The Stress Out Of Identifying Cost Of Goods Sold And Other Construction Accounting Confusions

Posted by Sharie DeHart on Tue, Apr 16, 2019

Contractors often ask us if they can buy our Chart Of Accounts with Cost of Goods Sold and import them into their QuickBooks Desktop file or their QuickBooks Online file. The answer is yes!

Click here for QuickBooks Desktop Chart of Accounts with Cost of Goods Sold

Click here for QuickBooks Online Chart of Accounts with Cost of Goods Sold

Direct Costs are tied to the jobs (field labor, material, and other cost items) Office material (pencils, paper, toner, etc. are overhead) Yes, an accountant could say these many pencils are used in the field, and that notepad is used in the truck.

The answer is the dividing line of what the DIRECT COSTS to the job and those are Cost of Goods Sold (COGS).

Read More

Topics: Invoicing, We Know Construction Accounting, QuickBooks For Contractors, Construction Bookkeeping

I would like to start my blog post by asking you to reflect on your WHY. Pause for a while and think about the reason or reasons why you started your business. I highly doubt that your answer is rooted in accounting tasks or involved any type of bookkeeping project at the slightest. It is apparent that you’re passionate about what you do and you love working in the construction industry, be your own boss, and have the freedom you’ve dreamed of.

I admit, small business owners - like myself, have learned to make the most of the resources we have. And as an entrepreneur, tend to take on the challenge of wearing multiple hats. Marketing your business, answering phone calls, responding to emails, scheduling appointments – to name a few. However, I am reminding you now that being a company owner and doing your accounting and bookkeeping requires a totally different skill set from being a construction expert in your field. When it comes to your financials, it would be wise to take a step back and let someone who specializes in bookkeeping do it for you. Not just any accountant or bookkeeper, but see to it that they are Construction Bookkeeping and Accounting Professionals.

Read More

Topics: QuickBooks For Contractors, Construction Bookkeeping, QuickBooks Setup Do It Yourself, QuickBooks Construction Accounting, Assisted Do-It-Yourself Contractor Bookkeeping

Profit Draining Invoice Errors Contractors Make Without Realizing It

Posted by Sharie DeHart on Fri, Apr 05, 2019

Creating an invoice for the entire project seems like it is the simplest way to track payments and have the current balance. The harsh reality is that if all of the work is NOT done, accounts receivable is reflecting a balance due that is NOT REAL. Without proper tracking and matching of income and expenses, most construction companies never know if they made a profit until the job is over.

However, due to your work’s nature, as construction contractors provide services on a per-job operation, issuing invoices make it all the more challenging and difficult than it has to be. The good news is that it doesn't have to stay that way. Consider the following invoicing errors contractors make and take actionable steps on how to avert them.

Read MoreTopics: Invoicing, QuickBooks For Contractors, Construction Bookkeeping, Payment Applications