Raising prices can be a sore subject. Many construction business owners like you assume doing so will spell the end of your competitiveness. But by not raising prices, you're simply letting inflation and your suppliers' maintenance of your margins quietly eat away at profitability. The bottom line is that costs will always rise long-term - at least with inflation.

That means you have to pass on the costs to your customers or consume those costs yourself to the point where one day, you'll have to either suddenly raise prices or accept the eventual failure of your business.

The worst thing you can do is avoid measuring your costs by sticking your head in the sand. Cost rises will catch up with you eventually, so take action to maintain your margins.

Read More

Topics:

Marketing Tracking,

Construction Marketing,

Construction Accountant Who Listens,

Contractor Marketing,

Contractor Tips,

Pricing Jobs,

How To Raise Prices

A USP (Unique Selling Proposition) is a compelling reason for your target market to choose your construction business over your competitor's. Examples range from cutting-edge service and product features to simply being more convenient and easier to find for the target market.

But it all boils down to meeting your local market's needs in a more accurate and improved way than the competition and being able to market these points more effectively.

By doing this, your business can stand out in the marketplace with a strong reputation attracting more clients.

Read More

Topics:

High Profit Repeat Construction Clients,

Construction Accountant Who Listens,

Clients or Customers,

Contractor Tips

When you go into business as a tradesperson, you often focus on performing your trade to the best of your ability – as it should be. With time, the quality of your work will speak for itself, which is the most valuable testimonial of all.

Before the internet was commercially available, just as many experts advised contractors about the layout and design of yellow page ads and which books to spend money on, I say you spend money because that is what it was - Marketing.

Many of us who owned and operated construction companies spent thousands of dollars on these experts. Based on their recommendations, we spent tens of thousands of dollars annually in full-page yellow page ads as close to the first position.

Read More

Topics:

Marketing Ideas For Contractors That Work,

Marketing Tracking,

Construction Marketing,

Construction Accountant Who Listens,

Contractor Marketing,

Contractor Tips,

Inbound Marketing For Contractors

We're in a dynamic, multicultural country with many different races of people from diverse origins, just within the domestic market; it's vital that you know who might be interested in your goods or services and how they could perceive particular messages.

Whichever specialty your construction business is in, cultural differences can directly impact your profitability. If you try to understand your crew's and clients' cultures – their customs and differences – you'll have a better chance of keeping them and gaining more, respectively.

Suppliers, vendors, and service providers respect leaders who have a vision, mindful and considerate, and can power through every obstacle to achieve success. They will support you in ways you cannot even imagine because it is in their best interest.

Decide how you want to lead, how you want to be respected, and the work culture you want to create.

Read More

Topics:

Contractor Tips,

cybersecurity,

Employee Fraud,

financial fraud

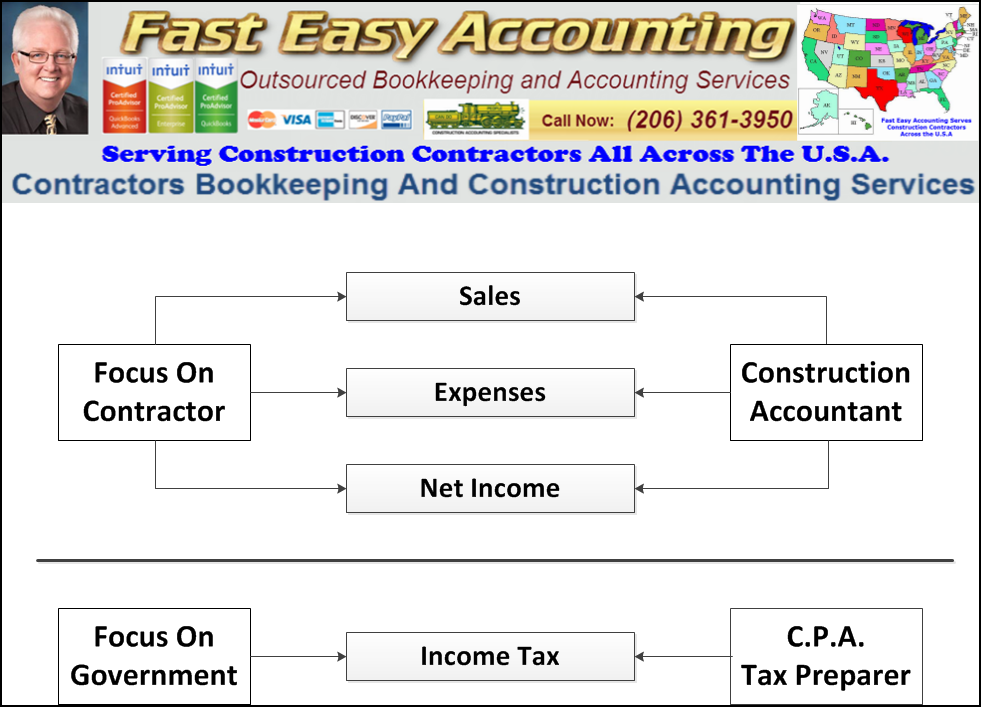

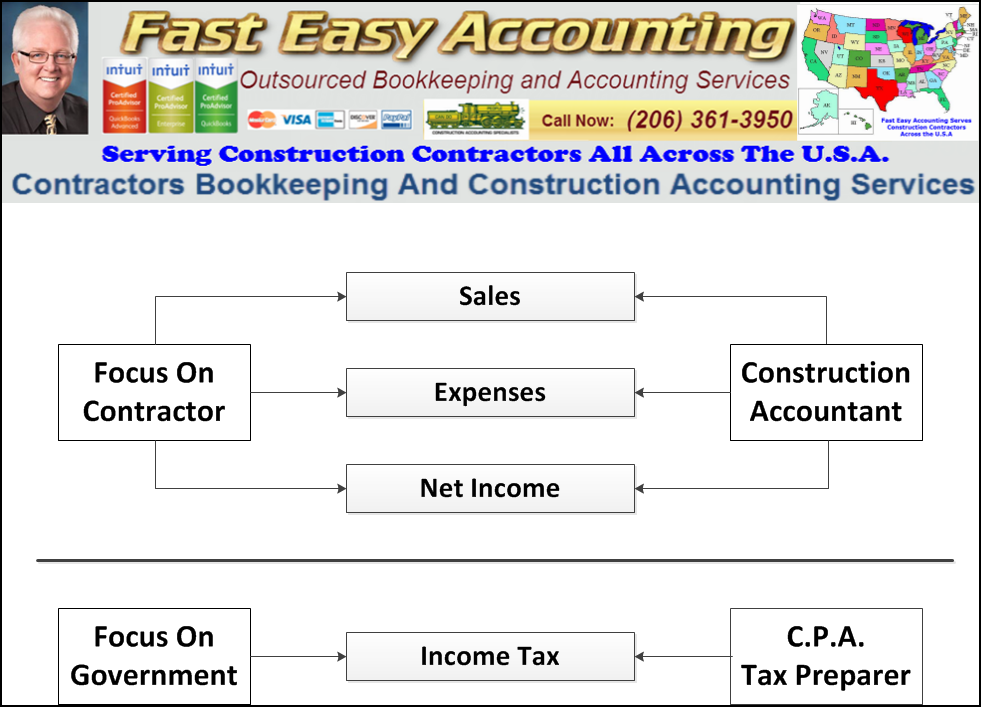

How often have you hired someone with the expectation that they know how construction works, and then you found out they did not know about it? You are a master in the construction industry, so you recognize what to look for in your particular field and quickly observe if someone has the skillsets, and you proceed accordingly.

You know what happens when you send your best Rough Carpenter that you pay piece work for framing spec from the ground up in all kinds of weather and working conditions to install some custom-made cherry wood cabinets with gold plated pulls and knobs in the home of your best client (who happens to be in the wealthiest neighborhood in your town). It is not a pretty sight.

Have you pictured a crew with muddy work gear and boots stepping onto your client's pristine floors? The dirty secret is that Tax Accountants operate like Rough Carpenters because they work fast and furious, and they are paid piece work. The main difference is that they earn the bulk of their annual income in three and a half months. This means they do not waste any time going through your receipts to ensure you get all the deductions you are entitled to.

Read More

Topics:

CPA Vs Construction Accountant,

When Contractors Need A CPA,

Construction Bookkeeping,

Construction Bookkeeping And Accounting,

Construction Accountant Who Listens,

CPA,

Contractor Tips

Unfortunately, fraudsters are out there. They want your money and identity, and they're getting more sophisticated. There's a wealth of opportunity for swindlers to take advantage of people because so much of what we do is now online. There are ways for you to protect yourself, both by taking action and being aware of what's going on.

While they might get less information from a small business, thieves will easily access it. If your construction company keeps any time-sensitive information on a computer network—personal information, credit card details, or other vital data—you need to ensure your cybersecurity is top-notch so you, your business, and your clients are fully protected.

As a small construction business owner, you may not have the significant security budget of a large company, but you can combat employee theft and protect yourself from financial losses if you can identify red flags and follow suitable preventive measures.

Read More

Topics:

Contractor Tips,

cybersecurity,

Employee Fraud,

financial fraud

Operating and growing your construction business requires more than functional and skilled employees, but it's an excellent start. You need a steady stream of quality, paying clients to keep your company afloat. Likewise, deciding on an online marketing plan can be overwhelming for company owners like you who are looking for affordable ways to nurture consistent, sustainable growth. With time in short supply, the key is to find one or two growth strategies that will get results at a minimal cost.

Building a construction business requires collaboration and partnership. The deployment of employees in a way that allows them to work together to problem-solve and act with a shared sense of urgency; and increasing brand awareness through an alliance with people in the industry are simple, cost-effective ideas for building your company within, in the office or job site, or externally through referral and online connections.

Read More

Topics:

Profit and Growth Strategies For Contractors,

Construction Bookkeeping And Accounting,

construction business partnership,

Boost Construction Profitability,

Construction Collaboration

Inflation has ballooned worldwide in recent months, and there's no question that small construction businesses are feeling the pinch. Supplies cost more, employees are hard to find, and your profits are shrinking.

This can lead to operating at a loss - spending more money than you make. Otherwise, you will eventually run out of cash reserves and be out of business. And while it's not uncommon, especially for new companies, it's still not ideal and shouldn't continue in the long term.

Be aware of what's going on in your industry and adjust. Customers judge a business based on perceived value. If you're at the bottom of the pack price-wise, they're likely to skip over you to get a good deal. Price yourself accordingly to attract quality clients.

Read More

Topics:

Construction Bookkeeping And Accounting,

Contractor Tips,

Improve Construction Cash Flow,

Boost Construction Profitability,

Inflation,

Construction Business Inflation

So you have a great business idea and are convinced you can make it work, but you don't have much capital to get your business off the ground. Juggling existing financial commitments such as a mortgage or bank loan could put a squeeze on your business plans. Many entrepreneurs use creative thinking and shrewd planning to get businesses off the ground with the smallest budgets.

Freelancers in all industries deal with the same problems due to the nature of their work. Most of you came from the skilled craftsman trades; some worked as construction company managers and have now started or thought of starting your business.

If you just did, congratulations, you have decided to own and operate a construction company. Practically, solo contractors manage every aspect of their business, but we are here to help you navigate it. Here are the things you need to consider (especially when you are on a limited budget) to keep it running.

Read More

Topics:

New Contractors,

Construction Cash Flow,

New Business Startup,

Construction Bookkeeping And Accounting,

Construction Company Startup Tips,

Contractor Tips

When you think of payroll, you might still envision paperwork and envelopes given to employees by hand. Even with direct deposit being the norm for years, there is still a significant paper component to manage.

You won't find a contractor using inefficient tools on the job site these days. The hammer or the nail gun? No question. While every contractor recognizes the flaws of using ineffective tools, they may still be losing money due to inefficient payroll tools and processes.

As with most things, payroll is going digital – for a good reason. There are many benefits to digital payroll for construction business owners and staff alike. Read on to learn why switching to paperless payroll could be right for you.

Read More

Topics:

Construction Cash Flow,

Construction Bookkeeping And Accounting,

Key Performance Indicators,

Contractor Tips,

Improve Construction Cash Flow,

Boost Construction Profitability