The Following Is An Outline From Dan Perry's Guest Appearance On The Contractors Success M.A.P. Podcast which you can listen to below. It is on iTunes, Stitcher Radio, Pocket Casts and all popular podcast directories.Dan Perry is the founder of HandymanStartup.com - a community dedicated to helping handymen, plumbers, electricians, and contractors understand business and marketing so they can get more customers, make more money, and enjoy their businesses. Connect with him at www.handymanstartup.com or on twitter @bigdhandyman.

Read MoreRandal DeHart

Recent Posts

Does QuickBooks Frustrate You? If You Answered "Yes" You Are Not Alone!

99.99% of all QuickBooks Issues can be traced back to two root causes:

- How QuickBooks setup was done originally

- How transactions are put into QuickBooks

QuickBooks Makes Construction Accounting

Look Easy As Microwave Popcorn

How many advertisements have you seen by Intuit, the maker of QuickBooks that makes it appear like accounting is so simple a five year old can do it. The truth is Intuit is a sales and marketing firm that sells and markets software. And QuickBooks is one of the big winners for them because it has removed a lot of the pain associated with accounting; but it is still accounting and certain principles still apply. For example "Debits" are on the left and when they are not we give them "Credit".

When you write a check in QuickBooks you can impact up to 27 different tables and hundreds of reports which means in the end there are thousands of things that can go wrong. Even those of us with a deep background in accounting have known for years there are several things QuickBooks allows users to do which can lead them down harmful paths. One of the worst ideas ever in the history of QuickBooks is putting your bank and credit card account numbers inside QuickBooks. I suspect this was done in response to users asking for it.

Don’t assume that QuickBooks will keep an uninformed bookkeeper or user for making mistakes and don't assume it will stop your from doing something that will cause financial harm to your construction company because it WON'T! Understand that QuickBooks is just a tool like a hammer is a tool and hammers do not know which nail to drive into which piece of wood.

The problem is that bookkeeper not trained in construction accounting don’t know which nails to drive where inside QuickBooks so they just start “hammering” and causing untold damage. What happens too often is they open the box, load the program, and start using it without help or guidance. This works fine for small phone apps, games and programs, like Publisher because if you make a mistake in Publisher the damage is limited to only one file. You can see and immediately correct your mistake and it doesn't impact your taxes, job costing reports, obtaining a loan, or running your construction company!

But if you or your contractors bookkeeper makes mistakes in your QuickBooks for Contractors file it might be months or years before anyone finds it and only then if they know what to look for in the financial and job costing reports to know if they are seriously wrong.

Read MoreTopics: QuickBooks Contractor Template

Unique Winning Strategies For Your Construction Company

Posted by Randal DeHart on Fri, Nov 28, 2014

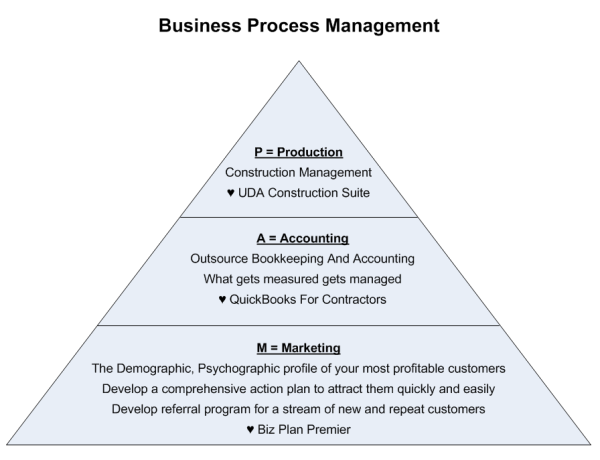

M.A.P. = Marketing + Accounting + Production

Large Profitable Construction - Companies have known about and used some form of Business Process Development (BPM) for hundreds of years. For 100+ years colleges and universities have opened the treasure trove of secrets to their business majors and provided them with an in-depth understanding of how BPM works. Click Here To Start Your Business Process Management Strategy

Read MoreTopics: Business Process Development For Construction, Business Process Management For Contractors

How A Contractor Recovered Their QuickBooks Data File After A Burglary

Posted by Randal DeHart on Fri, Nov 21, 2014

INTRODUCTION:

Do you have a disaster recovery plan to get your contracting company back on track after a flood, fire, earthquake or worse, a burglary? When your computer or laptop containing all your contracting company’s bookkeeping records are lost or stolen how will you know who owes you money and whom you owe money too?

According to the Federal Emergency Management Agency (FEMA) businesses that lost their information, technology for nine days or more after a disaster are bankrupt within a year.

The video below tells the story of a small remodeling contractor who arrived home after a relaxing weekend camping trip only to discover his computer containing all of his QuickBooks files, invoices, receivables, payables and payroll was gone and how we helped restore everything within twenty-four hours.

Sean Kavanaugh's Plumbing And Mechanical Contractor Insights Part 2

Posted by Randal DeHart on Fri, Nov 14, 2014

Today's Guest Article Is Part Two Of Sean Kavanaugh's Podcast Interview On Contractors Success M.A.P.

The Following Is An Outline From Sean Kavanaugh's Guest Appearance On The Contractors Success M.A.P. Podcast which you can listen to below. It is on iTunes, Stitcher Radio, Pocket Casts and all popular podcast directories.

Topics: Sean Kavanaugh, Plumbing Contractor, Mechanical Contractor

12 Warning Signs You Hired The Wrong Contractor Bookkeeping Service

Posted by Randal DeHart on Fri, Nov 07, 2014

Ten Keys To Hiring The Right Contractor Bookkeeping Service

Posted by Randal DeHart on Fri, Oct 31, 2014

Topics: Contractor Bookkeeping Services

Nicola Cairncross Interviews Randal DeHart, Construction Accountant

Posted by Randal DeHart on Fri, Oct 24, 2014

Topics: Nicola Cairncross

Unique QuickBooks Setup Tricks And Tips From The QuickBooks Expert

Posted by Randal DeHart on Tue, Oct 21, 2014

Many thanks to Mark McVeety, the creator of the FREE Quick-Start Shoreline weekly business workshops for inviting Fast Easy Accounting to present.

Topics: Shoreline Lunch And Learn, QuickBooks Setup Do It Yourself

Scam Artists Are Calling Contractors Claiming To Be From The IRS

Posted by Randal DeHart on Fri, Oct 17, 2014

Scammers are calling all kinds of people and business owners claiming to be from the IRS. This has been a popular and from all indications a very profitable swindle because it appears to be getting worse.

Topics: IRS Scam Imposters