Positive Thoughts And Inspirations For Construction Business Owners

Posted by Randal DeHart on Sat, Jul 28, 2012

Topics: Thoughts And Inspirations

Serious And Funny Construction Definitions Contractors Enjoy Reading

Posted by Randal DeHart on Fri, Jul 27, 2012

Beginning In The Mid 1960's While Working In My Parents Construction Company -I have been steadily accumulating a variety of terms to describe the construction industry. Some of them are intended to be funny, some are serious and the rest are entertaining. Please feel free to share them with your friends, relatives and most importantly contractors as they will appreciate the humor and perhaps find value in the words of wisdom we are sharing.

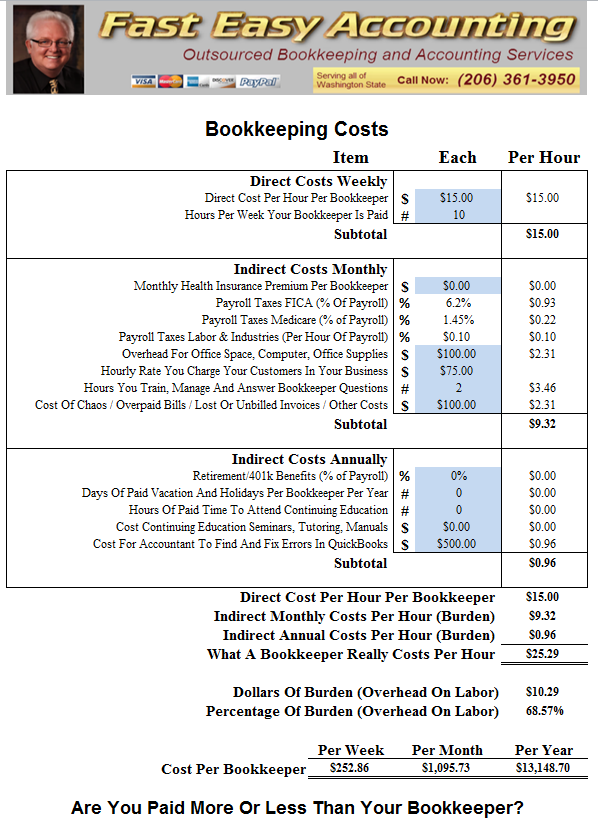

Why Hire Us For Your Contractor Bookkeeping Service Over An Employee?

Posted by Randal DeHart on Thu, Jul 26, 2012

Benefits of Hiring Fast Easy Accounting vs. an Employee

Flat Fee Not Hourly

Pick and choose what services you want. Basic contractor bookkeeping services, payroll processing, Quarterly Tax Returns, workers compensation insurance reports, WIP reports, Job Costing and more. We will work within your budget, so there are no surprises. In most cases our services are cheaper than hiring a qualified employee.

QuickBooks Consulting To Increase Contractor Sales And Profits

Posted by Randal DeHart on Thu, Jul 26, 2012

We have the knowledge, experience, staff and most importantly the system needed to convert your accounting software from any version of Quicken, Peachtree, QuickBooks Online, QuickBooks for Mac and any year or version of QuickBooks and improve the accuracy and make QuickBooks into an easy accounting system. Or we can simply get you caught up.

Topics: QuickBooks Consulting

Payment Collect - QuickBooks Payment Solution Helps Increases Sales

Posted by Randal DeHart on Wed, Jul 25, 2012

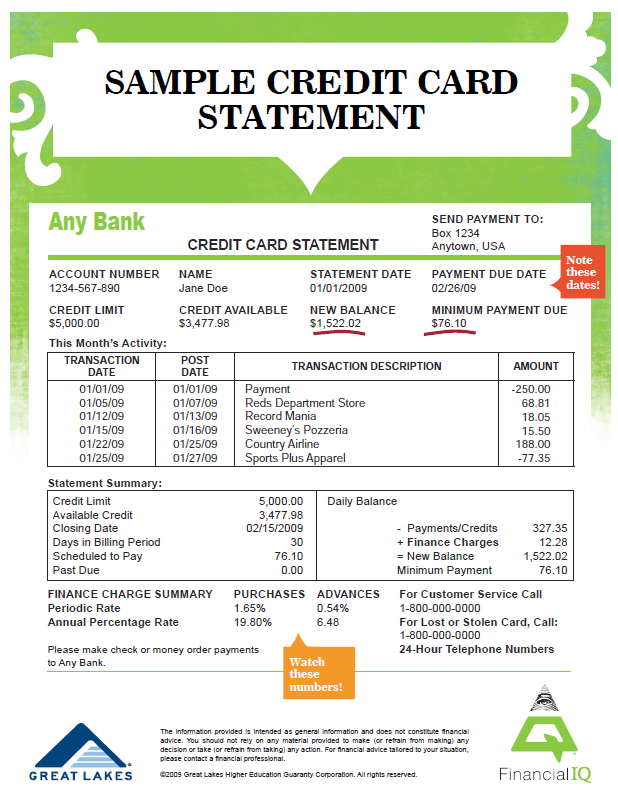

Software developer, Payment Collect LLC, offers unique payment solutions for companies using QuickBooks. Companies wanting to spend less time managing their accounts receivable and more time creating sales and managing accounts are turning to Payment Collect. Now, with one click, all invoices are available for instant payment through a number of available gateways. Once payment has been received, Payment Collect sends payment for processing and then updates the QuickBooks company file upon confirmation from merchant services.

Topics: Payment Collect, Accept Credit Cards

Salt Of The Earth Contractor

If You Are In This Contractor Group - You are the second largest group of the Four Types Of Contractors. Together you and your like-minded contractors combined production is more than the Professional Contractors and the Enterprise Contractors combined due to the sheer number of contractors similar to you.

Dog And Pick-Up Truck Contractor

If You Are In This Contractor Group - You are in the largest group of the Four Types Of Contractors. Together you and your like-minded contractors combined production is more than all the other groups combined due to the sheer number of contractors similar to you.

Small And Micro Construction Companies Have Unique Bookkeeping Needs

Posted by Randal DeHart on Sat, Jul 21, 2012

Construction Strategy Increases Profitability Not Field Operations

Posted by Randal DeHart on Sat, Jul 21, 2012

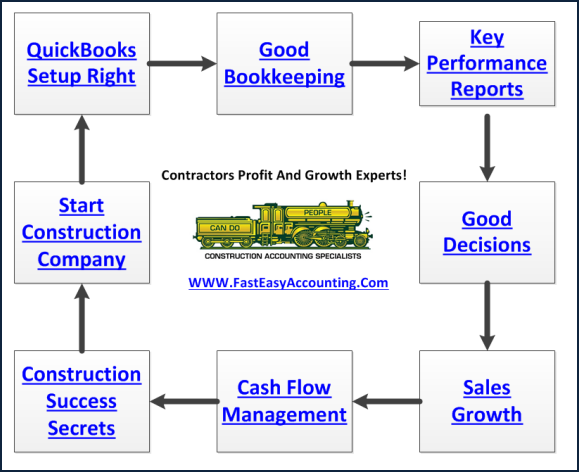

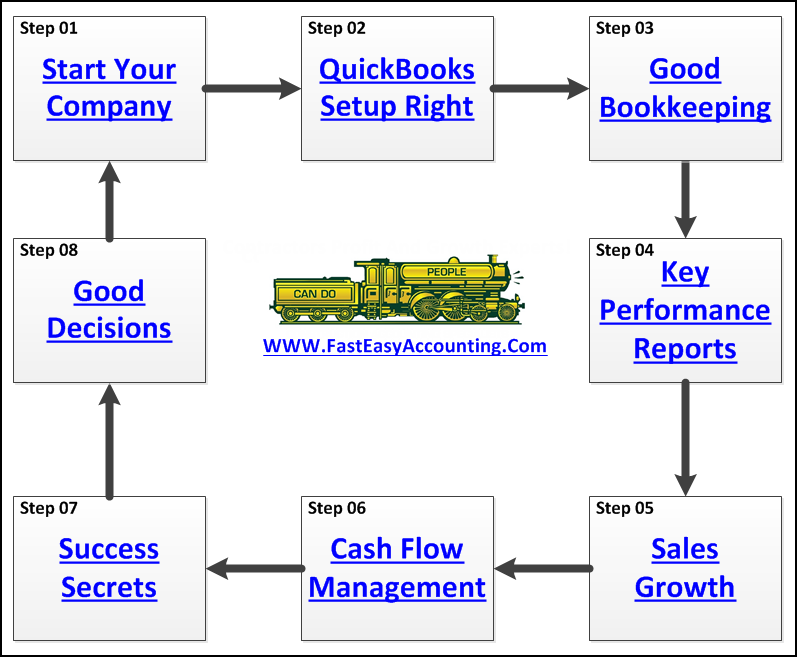

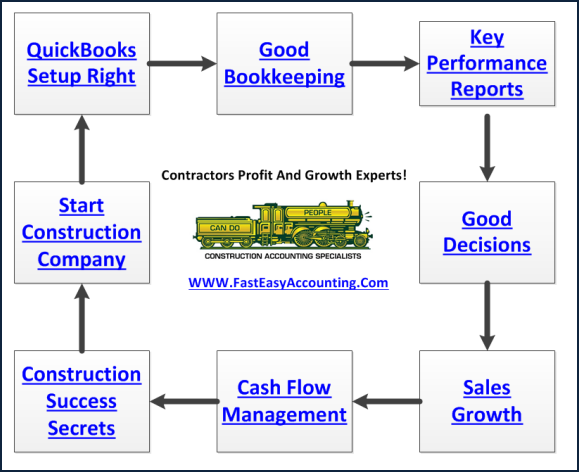

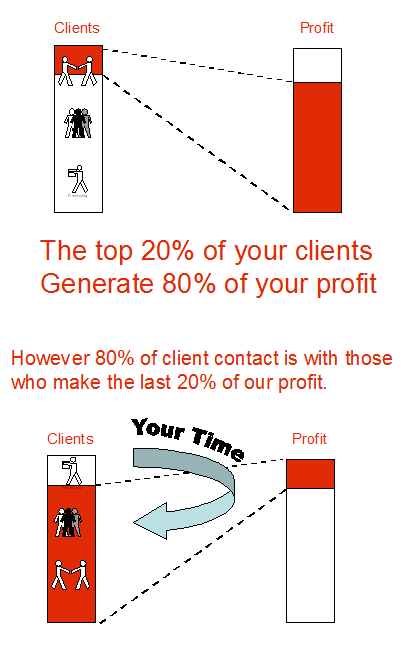

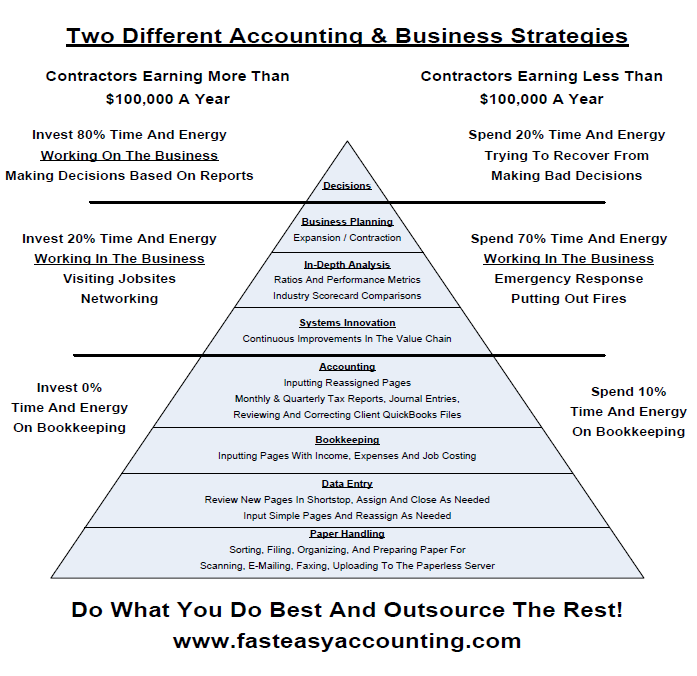

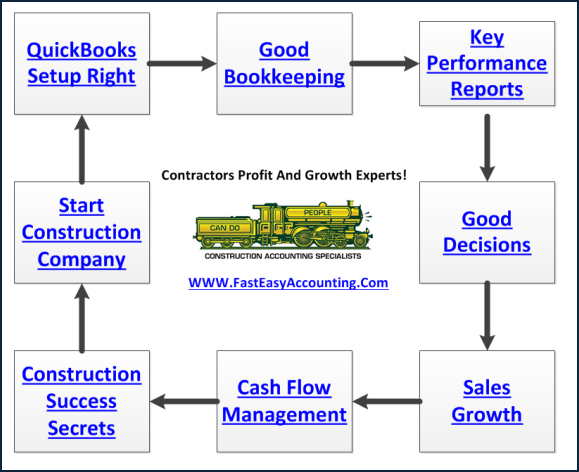

Strategic Construction QuickBooks Reports Optimize Profit And Growth

Strategy Comes From The Office - QuickBooks Reports and The 80-20 Rule For Construction is one of the tools you use to develop strategy for which markets and customers to focus your time on. The foundation of useful QuickBooks reports comes from having QuickBooks Setup and Professional Bookkeeping.

Hammer, Hammer Who Has The Contractor Hammer? L&I Has The Hammer!

Posted by Randal DeHart on Sat, Jul 21, 2012

Washington State Labor And Industries Has The Hammer And Contractors Without Insurance Look Like Nails!

Topics: Labor & Industries Insurance

Unlicensed Contractors Cannot Sue For Payment And May Lose Even More

Posted by Randal DeHart on Sat, Jul 21, 2012

Construction Bookkeeping, Payroll, Quarterly Taxes No B.S. Excuses

Posted by Randal DeHart on Fri, Jul 20, 2012

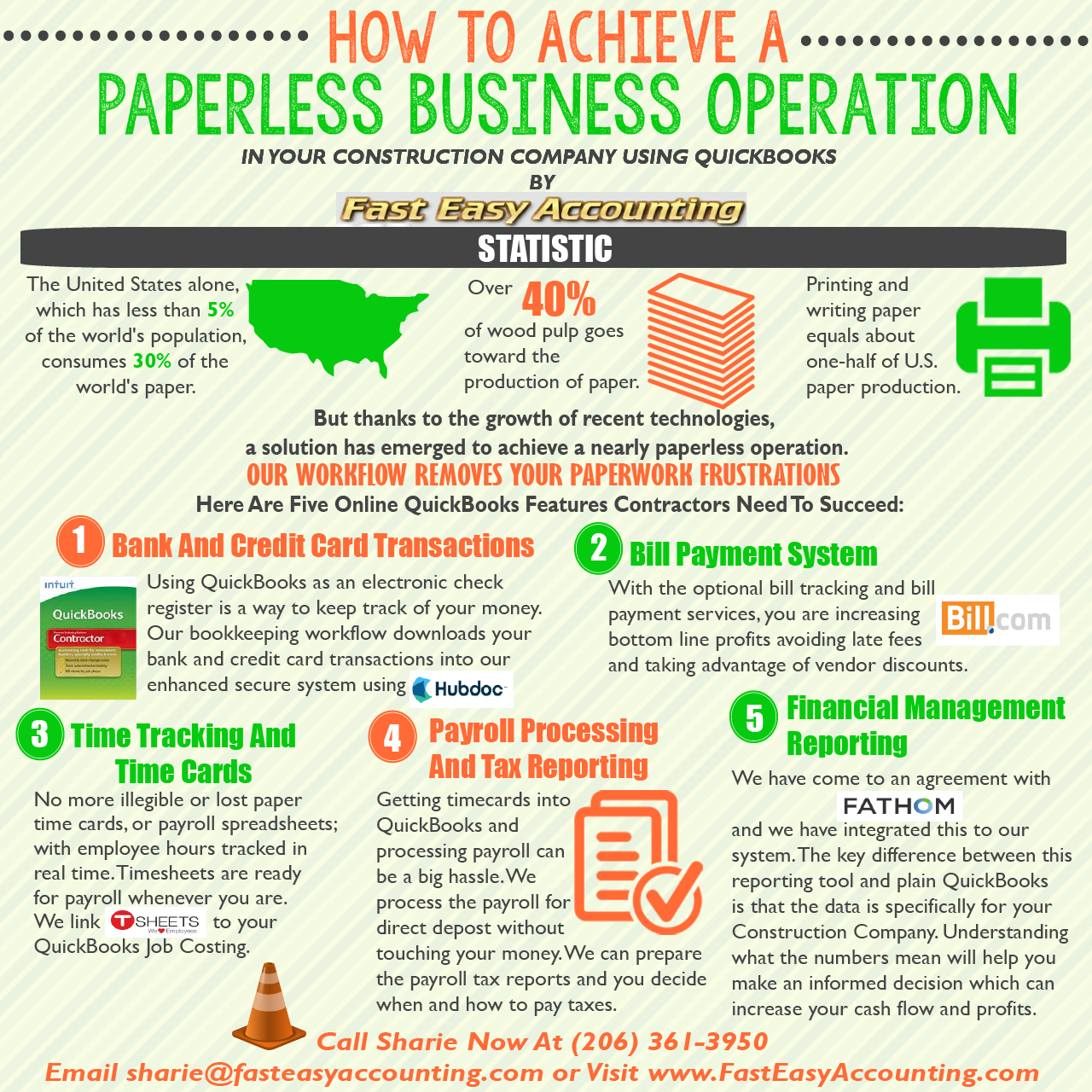

When You Think About - How much of your construction business expense is wasted on hiring, training and maintaining someone in your office who is being buried alive by paperwork trying to keep on top of all the bookkeeping, payroll processing, fill out the monthly and quarterly tax forms it should make you a bit angry!

QuickBooks Journal Entries Distort Construction Job Cost Reports

Posted by Randal DeHart on Wed, Jul 18, 2012

Lately We Are Seeing An Increase In QuickBooks Journal Entries

Journal Entries - Are a quick and dirty way to get transactions in without putting forth time and effort to enter each transaction. In the short run you save time; in the long run you can forget about accurate Job Cost Reports.

Custom Home Builders Have Unique Bookkeeping Needs

-

Not Just Any Bookkeeper Will Do - Too often spec home builders hire a bookkeeper and end up with the wrong bookkeeper if they believe all bookkeepers are the same. Nothing is further from the truth. You would never hire a construction worker with a background as a handyman to be on your framing crew because they are trained to take their time, lay out tarps in the work area and think about every piece of lumber before cutting and installing it. They could do a fine job, the only question is how long would it take and would you be able to charge the homeowner enough to make a substaintial profit?

-

QuickBooks Setup - And choosing the correct QuickBooks Version is the most critical part of all because it is the foundation upon which your entire financial system is built. Put the wrong foundation under your business and it will not matter who is doing the bookkeeping because it will always be a mess and you will never get the reports you really need in order to operate and grow your business profitably. Your Board of Advisors and especially your banker will be unhappy; however, they may not say it outright, just that your loans, lines of credit and referral opportunities may be limited.

-

Custom Home Builders - Need people trained in construction bookkeeping who understand how to put together a bank draw correctly, not someone with experience in regular bookkeeping. The difference between a Professional Bookkeeping Service and a Cheap Bookkeeper can cost you tens of thousands of dollars a year or more on your bottom line profit.

-

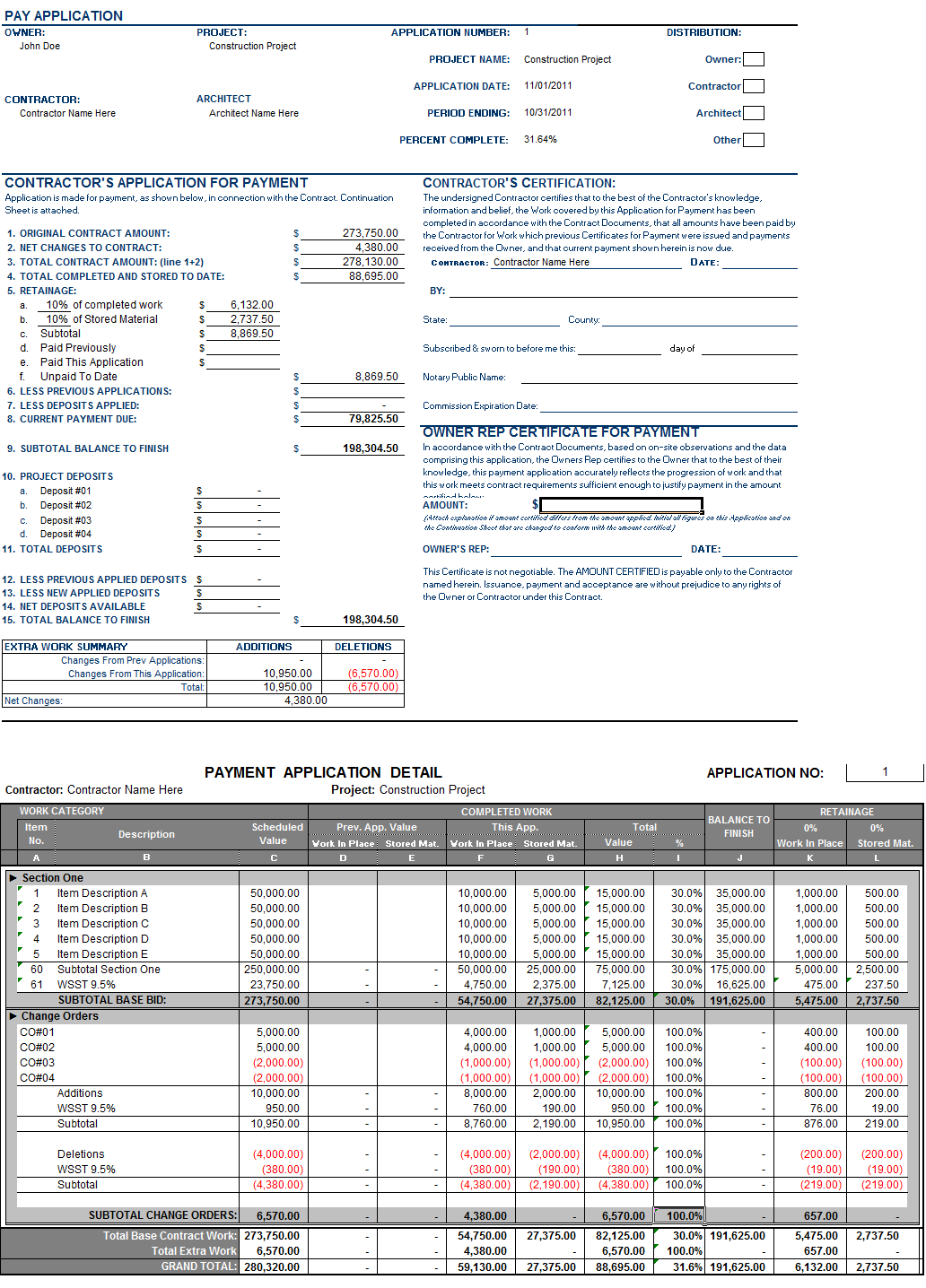

Custom Home Building - Is similar to other construction accounting because the custom home builder accumulates costs in the Cost of Goods area of QuickBooks. One of the areas where it is different is when the builder negotiates "Allowances" for fixtures and finished goods. Often during construction there are a numbe of change orders, addtions and deletions and a lot of the time the homeowner wants to provide certain materials. Whenever there is a large single peice of equipment or part the custom home builder may ask for a deposit before placing the order. For a short while the deposit is actually a liability not income until the part is futher along in the process.

-

Professional Construction Accounting Firms - Have a Bookkeeping System to generate the same results every time. During construction there will be some expenses that should be properly allocated to Direct and Indirect Costs of Goods sold and some to Expenses and only a Skilled Professional Bookkeeping Service knows the difference.

-

Many Bookkeepers Have Been Stumped - Trying to force QuickBooks to do the accounting for custom home building and I understand and empathize with their plight. We spent years and thousands of dollars developing a process that works with QuickBooks. And every year we continually innovate and add new features and benefits to it! We know what to do!

-

Custom Home Builders - Who also do some remodel work, buy houses for rental inventory and buy houses to fix up and sell, house flippers, create special problems for regular bookkeepers. There is only one method that works well and we have we have a system that allows all the bookkeeping to be done inside QuickBooks and it can save you time, manage cash flow and save money on taxes. We know what to do!

-

Complex Bank Draws - And owners who insist on full accountabilty using their own form, their lenders forms or ours with milestones, multiple deposits, payments, changes, payment history and running totals that your client can follow is something we can prepare for you and send them to you as often as you need them.

What You Can Expect From Our Custom Home Builder Contractor Bookkeeping Services:

-

Professional Bookkeepers with over 10,000 hours of practice

-

Retention Tracking System

-

Optional scanner for sending paperwork to us with the touch of a button

-

Five Key Performance Indicator Reports for monitoring your business

-

Business Coaching - Someone who understands your business to talk with

-

Access to Meeting Space 24/7/365 - For training, meeting clients and vendors and quiet work place

-

Cloud based document storage

In The Long Run We Are Less Expensive Cheap Bookkeeper

And We Offer Cloud Based Desktop QuickBooks

-

Fully functioning QuickBooks desktop version

-

Export to Excel and Word which is part of the service

-

Print anything directly from QuickBooks, Word or Excel on your own printer

QuickBooks Expert Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Commercial Tenant Improvement Contractors Have Unique Bookkeeping Needs

Posted by Randal DeHart on Wed, Jul 18, 2012

Spec Home Builders Have Unique Bookkeeping Needs

-

Not Just Any Bookkeeper Will Do - Too often spec home builders hire a bookkeeper and end up with the wrong bookkeeper if they believe all bookkeepers are the same. Nothing is further from the truth. You would never hire a construction worker with a background as a handyman to be on your framing crew because they are trained to take their time, lay out tarps in the work area and think about every piece of lumber before cutting and installing it. They could do a fine job, the only question is how long would it take and would you be able to sell the house and make a profit?

-

QuickBooks Setup - And choosing the correct QuickBooks Version is the most critical part of all because it is the foundation upon which your entire financial system is built. Put the wrong foundation under your business and it will not matter who is doing the bookkeeping because it will always be a mess and you will never get the reports you really need in order to operate and grow your business profitably. Your Board of Advisors and especially your banker will be unhappy; however, they may not say it outright, just that your loans, lines of credit and referral opportunities may be limited.

-

Spec Home Builders - Need people trained in construction bookkeeping who understand how to put together a bank draw correctly, not someone with experience in regular bookkeeping. The difference between a Professional Bookkeeping Service and a Cheap Bookkeeper can cost you tens of thousands of dollars a year or more on your bottom line profit.

-

Spec Home Building - Is completely different from other construction accounting because the builder accumulates costs as assets until the HUD-1 statement is entered into QuickBooks. After the property is sold and closed the HUD-1 statement is entered into QuickBooks and that is the only time Cost of Goods Sold should ever appear as it relates to that house.

-

Professional Construction Accounting Firms - Have a Bookkeeping System to generate the same results every time. During construction there will be some expenses that should be properly allocated to Costs of Goods sold and some to Expenses and only a Skilled Professional Bookkeeping Service knows the difference.

-

Banks Sometimes Ask For - Updated Profit and Loss and Balance Sheet Reports in the middle of construction before releasing a big draw just to verify where the money is being spent and to make certain you have a firm grip on your business. It is critical that all the transactions are put in properly because if your financial reports show Cost of Goods Sold on houses under construction makes your banker think you may not be in control of your business. Perception is reality and you can "explain your situation to your banker" just know ahead of time it will fall on deaf ears because your banker has to justify every loan in their portfolio to their supervisor and a loan committee that don't know you and don't care one bit about you or "your situation".

-

I Have Seen Too Many - Spec builders lose money on a house under construction because the bank pulled the financing and demanded immediate payment on the outstanding loan balance due to shaky financial reports. Yelling at the Incompetent Bookkeeper made them feel better; however, the financial damage to them, their families and their businesses was catastrophic. All because they hired the wrong bookkeeper.

-

Many Bookkeepers Have Been Stumped - Trying to force QuickBooks to do the accounting for spec home building and I understand and empathize with their plight. We spent years and thousands of dollars developing a process that works with QuickBooks. And every year we continually innovate and add new features and benefits to it! We know what to do!

-

Spec Home Builders - Who also do some remodel work, buy houses for rental inventory and buy houses to fix up and sell, house flippers, create special problems for regular bookkeepers. There is only one method that works well and we have we have a system that allows all the bookkeeping to be done inside QuickBooks and it can save you time, manage cash flow and save money on taxes. We know what to do!

-

Complex Bank Draws - Using the lenders forms or ours with milestones, multiple deposits, payments, changes, payment history and running totals your bank inspector can follow is something we can prepare for you and send them to you as often as you need them.

What You Can Expect From Our Remodel Contractor Bookkeeping Services:

-

Professional Bookkeepers with over 10,000 hours of practice

-

Retention Tracking System

-

Optional scanner for sending paperwork to us with the touch of a button

-

Five Key Performance Indicator Reports for monitoring your business

-

Business Coaching - Someone who understands your business to talk with

-

Access to Meeting Space 24/7/365 - For training, meeting clients and vendors and quiet work place

-

Cloud based document storage

In The Long Run We Are Less Expensive Cheap Bookkeeper

And We Offer Cloud Based Desktop QuickBooks

-

Fully functioning QuickBooks desktop version

-

Export to Excel and Word which is part of the service

-

Print anything directly from QuickBooks, Word or Excel on your own printer

We Remove Spec Home Builder's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+

Topics: Bookkeeping Services For Spec Home Builders, Builders Bookkeeping Services

Electrical Contractors Have Unique Bookkeeping Needs

-

Not Just Any Bookkeeper Will Do - Too often electrical contractors hire the wrong bookkeeper mistakenly believing all bookkeepers are the same. Nothing is further from the truth. Not all electricians are the same. You would never hire a rough-in electrician with a background in new construction commercial work to be part of your residential remodeling crew because they are trained to rip and tear and work fast will little or no concern for anyone or anything that gets in their way. The resulting destruction to you, your crew, your company and the poor family whose home you are working would be extremely expensive.

-

QuickBooks Setup - And choosing the correct QuickBooks Version is the most critical part of all because it is the foundation upon which your entire financial system is built. Put the wrong foundation under your business and it will not matter who is doing the bookkeeping because it will always be a mess and you will never get the reports you really need in order to operate and grow your business profitably. Your Board of Advisors and especially your banker will be unhappy; however, they may not say it outright, just that your loans, lines of credit and referral opportunities may be limited.

-

Electrical Contractors - Need people trained in construction bookkeeping not someone with experience in regular bookkeeping. The difference between a Professional Bookkeeping Service and a Cheap Bookkeeper can cost you tens of thousands of dollars a year or more on your bottom line profit.

-

We Know What To Do - For bookkeeping and reports for you no matter how you charge: Time and Material, Flat-Rate, Cost Plus, Not-To-Exceed, Underground, Rough-In, Trim, Milestones and several other methods.

-

We Know What To Do - No matter how you pay your electrician: Hourly, Commission, Percentage, Salary, Blended Salary and Commission, Prevailing Wage and more.

-

Inventory Tracking - Can be a nightmare and we have a system for it.

-

Job Deposits - Customer down payments can be input several ways. There is only one method that will help manage cash flow and save money on taxes and we know how to do it and track it for you in QuickBooks.

-

Complex Invoicing - With multiple deposits, payments, change orders, payment history and running totals your customer can follow. We prepare these and send them to you as often as you need them.

What You Can Expect From Our Electrical Contractor Bookkeeping Services:

-

Professional Bookkeepers with over 10,000 hours of practice

-

People who understand plumbing because we owned and operated plumbing companies

-

Retention Tracking System

-

Optional scanner for sending paperwork to us with the touch of a button

-

Five Key Performance Indicator Reports for monitoring your business

-

Business Coaching - Someone who understands your business to talk with

-

Access to Meeting Space 24/7/365 - For training, meeting clients and vendors and quiet work place

-

Cloud based document storage

In The Long Run We Save You Time And Money Over Hiring A Cheap Bookkeeper Who Knows Nothing About Electrical Contracting And We Offer Cloud Based Desktop QuickBooks!

-

Fully functioning QuickBooks desktop version

-

Export to Excel and Word which is part of the service

-

Print anything directly from QuickBooks, Word or Excel on your own printer

Profitable Construction - Companies have known about and outsourced bookkeeping for a long time and now you know about it too!

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+

Plumbing Contractors Have Unique Bookkeeping Needs

-

Not Just Any Bookkeeper Will Do - Too often plumbing contractors hire the wrong bookkeeper mistakenly believing all bookkeepers are the same. Nothing is further from the truth. Not all plumbers are the same. You would never hire a rough-in plumber with a background in new construction commercial work to be part of your residential remodeling crew because they are trained to rip and tear, yell, get aggressive and bully everyone and everything in their way. The resulting destruction to you, your crew, your company and the poor family whose home you are working would be extremely expensive. Construction bookkeeping you need people trained in construction bookkeeping.

-

QuickBooks Setup - And choosing the correct QuickBooks Version is the most critical part of all because it is the foundation upon which your entire financial system is built. Put the wrong foundation under your business and it will not matter who is doing the bookkeeping because it will always be a mess and you will never get the reports you really need in order to operate and grow your business profitably. Your Board of Advisors and especially your banker will be unhappy; however, they may not say it outright, just that your loans, lines of credit and referral opportunities may be limited.

-

Plumbing Contractors - Need people trained in construction bookkeeping not someone with experience in regular bookkeeping. The difference between a Professional Bookkeeping Service and a Cheap Bookkeeper can cost you tens of thousands of dollars a year or more on your bottom line profit.

-

We Know What To Do - For bookkeeping and reports for you no matter how you charge: Time and Material, Flat-Rate, Cost Plus, Not-To-Exceed, Underground, Rough-In, Trim, Milestones and several other methods.

-

We Understand Plumbing - Because we have owned and operated plumbing companies. Randal DeHart, our co-founder served a plumbing apprenticeship in the late 1970's and is still licensed as a Journeyman Plumber PL01 in Washington State. We not only talk the talk we walk the walk. We know exactly what challenges you face every day and we can be a valuable resource for you and your plumbing company.

-

We Know How To - Do the bookkeeping and reports for you no matter how you charge: Time and Material, Flat-Rate, Cost Plus, Not-To-Exceed and several other methods.

-

We Know How To - Do the bookkeeping and reports for you no matter how you pay your plumbers: Hourly, Commission, Percentage, Salary, Blended Salary and Commission, Prevailing Wage and more.

-

Inventory Tracking - Can be a nightmare and we have a system for it.

-

Job Deposits - Customer down payments can be input several ways. There is only one method that will help manage cash flow and save money on taxes and we know how to do it and track it for you in QuickBooks.

-

Complex Invoicing - With multiple deposits, payments, change orders, payment history and running totals your customer can follow. We prepare these and send them to you as often as you need them.

What You Can Expect From Our Plumbing Contractor Bookkeeping Services:

-

Professional Bookkeepers with over 10,000 hours of practice

-

People who understand plumbing because we owned and operated plumbing companies

-

Retention Tracking System

-

Optional scanner for sending paperwork to us with the touch of a button

-

Five Key Performance Indicator Reports for monitoring your business

-

Business Coaching - Someone who understands your business to talk with

-

Access to Meeting Space 24/7/365 - For training, meeting clients and vendors and quiet work place

-

Cloud based document storage

In The Long Run We Save You Time And Money Over Hiring A Cheap Bookkeeper Who Knows Nothing About Plumbing And We Offer Cloud Based Desktop QuickBooks!

-

Fully functioning QuickBooks desktop version

-

Export to Excel and Word which is part of the service

-

Print anything directly from QuickBooks, Word or Excel on your own printer

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+

Topics: Bookkeeping For Plumbing Contractors, Outsourced Bookkeeping Services For Plumbing Contr

Is Your Bookkeeper Training You Or Are You Training Them?

Posted by Randal DeHart on Wed, Jul 18, 2012

One of the biggest challenges in having an in-house bookkeeper is training them to deliver consistent results and reports you can trust and make intelligent decisions with day after day, year after year.

Topics: Bookkeeper Training Owner?

The Strategy of Preeminence

The Strategy of Preeminence - At Fast Easy Accounting simply means our clients are under the care and protection of professionals who are looking out for their best long-term business interests similar to how your physician and/or spiritual advisor supports you in your personal life.

Happy July 4th To All Contractors And Those Who Support Them!

Posted by Randal DeHart on Wed, Jul 04, 2012

Topics: July 4th Celebration

Topics: Our Favorite Clients