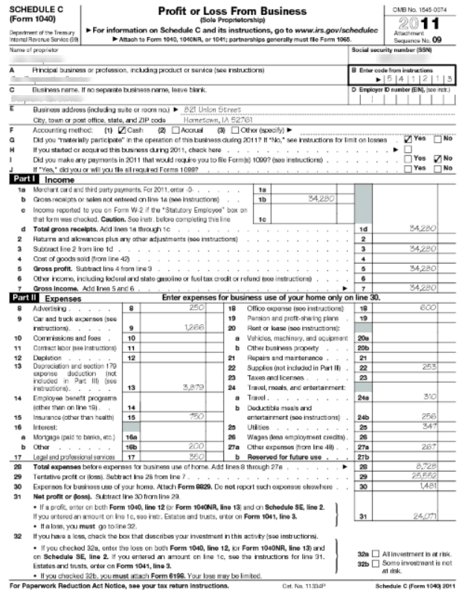

Below is a copy of the "Schedule C” it is the standardized format from the Internal Revenue Service.

Besides the bottom number, what does it tell you? I suspect minimal information. Why? Because the Internal Revenue Service has rules/regulations/restrictions about their forms and as much as they want to cram in more detail. How many pages? What font size? The form becomes the "Bigger Bucket" theory.

The "Bigger Bucket Theory" is where data input installs as many transactions as possible into a single line. For example, income can be all of the deposits from bank statements, which may have come from a single z-tape each day. Or Utilities, Office supplies, Marketing, Cost of Goods Sold (COGS) are classified as "Expenses." As the business owner, you may want to know more specific information about your costs and your income to make intelligent decisions.

The annual business tax return doesn't need to know which client is profitable – it's all income, it doesn't need to know the details about Costs of Goods Sold – it's all material (or just an expense). It is not relevant to the tax accountant. Remember, it's the "Big Bucket" theory. Of course – most tax returns have gotten longer and longer saying the same thing over and over again.

If your construction company files annual tax return as Sub-Chapter S, you know that most of the numbers transfer over to your personal return, and the numbers repeat again.

We have all heard "Garbage In" and "Garbage Out." It is becoming more common to do the bookkeeping "fast"; after all, it should only take about 10 minutes a day. One shortcut is downloading transactions directly from the bank.

Tax Accountants Typically set up QuickBooks Chart of Accounts to map directly into their tax software, which makes it easy to download from the bank "Big Bucket" theory again.

What is the purpose of your accounting system? To help you run your business more efficiently or file your taxes? Neither choice is good or bad as long as you have made a choice and understand the outcome.

Like most people, I go to my bank website often, and one of the things I have discovered is that all banks appear to treat each transaction uniquely. How do you get money out of your checking account?

- Do you write a paper check that is manually presented to the bank?

- Do you write a paper check that is electronically presented to the bank?

- Do you use your bank's online bill pay that mails out a paper check you can present to the bank?

- Does your bank's online bill pay – use EFT to transfer your funds to the vendor?

- Do you pay online using another bill pay service?

- Do you pay online by going directly to your vendor's website?

- Do you pay online using pay pal bank?

From the bank's transaction report, it looks straightforward. When the actual bank statement comes, the transactions can look differently. Bank breaks transactions into Checks / Debit / ACH / EFT – Vendors may have a different name on the account that accepts each of these types of transactions.

Downloading transactions from your bank can be an excellent time-saver if all goes well. I have heard stories of tax accountants without permission from their clients (they know everything they need to know to file your taxes), downloading a whole bunch of transactions into QuickBooks without correctly mapping them.

Construction companies have very complex Work In Progress (WIP), Job Costing and Job Profitability Reporting, and Other QuickBooks Reporting needs, which means some transactions must be coded to Items and some to Accounts for the reports to be accurate.

When in doubt, many times, the Bad Bookkeeper or whoever is doing the bookkeeping will send the transaction to the owner's draw, personal expenses, or some other wrong place.

This is because too often, the business owner sees all accounting costs as "Overhead and a Waste Of Money," and they want the "Cheapest Option Possible," and the "tax accountant is the only one who needs the information anyway" so why not let them do it.

We know several Tax Accountants that are a real pleasure to work with because they do not try to do bookkeeping in the off-season of tax preparation. They like clean and tidy QuickBooks - with reports and balances that make it is easy for them to review the Profit and Loss (P&L) and Balance Sheet, consider their client's entire financial picture, make decisions as needed and complete the annual tax return. And yes, a good tax accountant takes more than 15 minutes to complete their client's business return.

We recommend a Tax Accountant to complete your annual tax return for several reasons:

- They are a fresh set of eyes reviewing your QuickBooks and your business as a whole.

- They are an important part of your Board of Advisors.

- It makes it easier to get bank loans because the bank knows you have more than one person in your accounting.

- We have used Tax Accountants for our business and personal annual returns for over thirty years.

Here are three more ways to take the stress out of tax time and get the most out of your return:

Know your credits and deductions

Small businesses typically benefit from a wide range of tax credits. From special allowances for research and development to programs that supplement wages for student employees and apprentices, knowing which credits apply to your business can save you a bundle on taxes.

It's also essential for SMBs to be savvy about deductions. After all, you want to keep as much of your hard-earned revenue as possible. Often-overlooked items you may be able to deduct include:

- Seminars, classes or conventions you attended to improve your professional skills;

- Unused inventory that you've donated to charity (a good reason to consider donating your overstock, rather than paying for storage); and

- Capital assets, such as office furniture, computers, and equipment.

Speak to your accountant about the full range of available deductions you can plan for each tax year.

Be careful about what you claim

If you run your business out of your home, you may be able to claim a portion of expenditures like utilities, insurance, property tax, and rent. But you'll need to keep good records, and all your receipts, to justify why you've allocated business costs to your home office.

The same goes for home office computers and mobile phone expenses. Tax authorities will want to see how you've separated the personal and professional use of these assets when you claim them as work expenses.

Want to claim drive-time as a work expense? Ensure you submit a log of your business-related mileage, so you can demonstrate how your vehicle was used for professional purposes.

Don't miss the deadline

This should go without saying, but every year construction business owners are hit with severe penalties for filing taxes late. Missing the deadline can have a range of negative repercussions, including:

- Added interest to amounts owing, plus a late payment penalty;

- Losing your claim to a refund;

- Loss of credits toward retirement or disability benefits; and

- Delay of loan approvals (lenders require a copy of your filed tax return to process your application).

Final thoughts

Always seek a professional's advice. Current technology has made it easier than ever for small business owners to file for themselves, but when it comes to thoroughness and accuracy, nothing can replace the expert advice of an accountant.

Consult a professional well in advance, to ensure you're getting the most out of your tax return, and that your documentation is complete. On the bright side, accounting fees are often tax-deductible!

P.S.

With networking and building connections in mind, we are excited and honored that Randal is nominated for the 2020 Small Business Person Of The Year award in our city. If you are on Alignable, I would appreciate it if you can connect with us and "like" our recommendation.

Screenshot of Alignable nomination

About The Author:

![]() Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or sharie@fasteasyaccounting.com

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or sharie@fasteasyaccounting.com

OUTSOURCED ACCOUNTING FOR

THE BUSY CONTRACTOR

IN A MOBILE ENVIRONMENT

|

|

|

|

Download the Contractors APP today from the App Store or Android Store

Access Code: FEAHEROS

Click here to download the App on Android:

Click here to download the App on iOS:

Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?