Although not intentional, this could be considered a part 2 of last Friday’s blog/podcast episode or a continuation post dedicated to all brand-new contractors who just started their own company, to trade professionals who would like to restart their bookkeeping system, or simply to all our valued email subscribers – old and new.

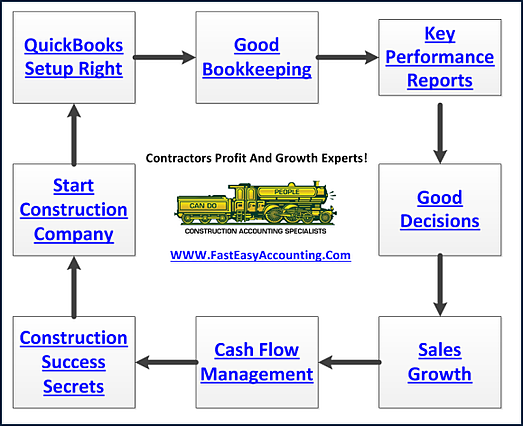

The time, effort, and money you’ve put through in running your construction business is a testament of your commitment to this industry. So, let me start this guide by telling you to do what you do best and outsource the rest. The “rest” as you know, is where your cash flow and profit depend – construction bookkeeping and accounting.

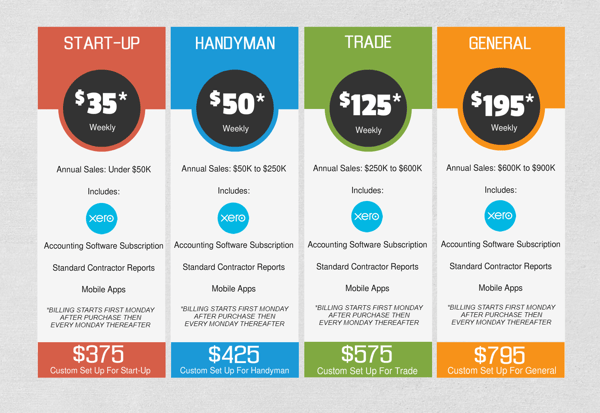

Utilizing QuickBooks or Xero rely upon how you get paid, the type of work your company does, and if you need job costing. Xero accounting online works best if you:

- Need to get paid faster and easier

- Have simple jobs you invoice individually

- Need to invoice customers at the job site

- Need KPI (Key Performance Indicator) Financial Reports

- Want professional Construction Accounting at lower costs

Xero Accounting Online saves us time in data entry which means we can offer contractors bookkeeping services at substantial savings over QuickBooks bookkeeping services and provide more in-depth financial reporting with some of the reports being updated within seconds of when the transactions are received.

Invoicing In The Field - when you or your employee finishes a job you can use your smartphone, tablet or web-enabled device to put together an invoice and if you are connected to the web Xero will have updated your Sales Report, Profit & Loss Report, Balance Sheet Report and a lot more reports before you finished reading this sentence.

The Key To Making Xero Accounting Online Work is having it properly setup and maintained. It is easy enough that anyone can setup the basic company file just like anyone can get on a backhoe and run it. Especially if you have watched the professionals do it for several years as I have because they make it look so "Easy...".

Perhaps you own a service and repair firm that specializes in plumbing, electrical, HVAC, or maybe a handyman service or someone who does small construction projects that last from a few hours to a few days and you only need to give your customer or client one invoice?

If this describes you then perhaps Xero Accounting Online is a better fit for you than QuickBooks.

Xero Accounting Online Conversion

Do you want to use Xero Accounting Online, but dread moving everything from QuickBooks or some other accounting software? We can do it all for you:

- Enter all of your year-to-date transactions

- Enter all of your Accounts Receivable (Sales)

- Enter all of your Accounts Payable (Purchases)

- Previous year-end bank, credit card and other account balances

- Activate your bank and PayPal feeds for downloading into Xero

- Enter all your customer and vendor contact information

Xero Accounting Online Setup

If you are a new company just starting out if you qualify we can set up your company on Xero Accounting Online and give you 30 days of Xero Accounting Online for FREE so you can find out if Xero is right for you!

- Set up your organization in Xero Accounting Online

- Prepare an application for Tax-ID number, if needed.

- Set up your Chart of Accounts

- Connect your bank and PayPal feeds

- Give you a tour of the system and how it works

- Provide ongoing virtual CFO support (We are more than bookkeeping services provider!)

- Contact Sharie 206-361-3950 or email sharie@fasteasyaccounting.com

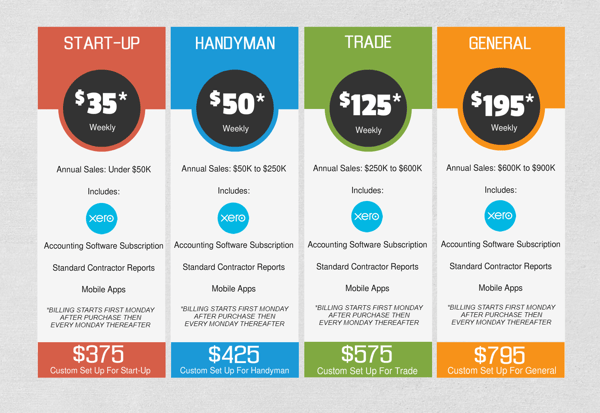

Xero Bookkeeping Services:

- Invoicing

- Daily reconciliation of bank feeds

- Weekly reporting

- Monthly reporting

- Year-end reporting for your tax preparer

- Year-end updates and adjustments from your tax preparer

- Options for payroll

- Options for time keeping and project management

- Options for receipt storage

We are also pleased and honored to let you know that we recently received an award from Xero. We are extremely grateful for the recognition of our work and will continue to provide value to our clients by providing Xero accounting services.

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes.

The Information Shown Below Is From Fast Easy Accounting

Download the Contractors APP today from the App Store or Android Store

Access Code: FEAHEROS

Click here to download the App on Android:

Click here to download the App on iOS:

Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

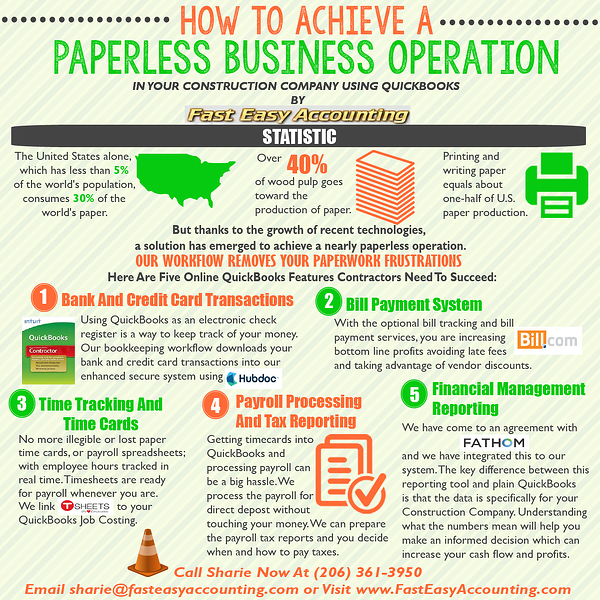

We Remove Contractor's Unique Paperwork Frustrations