How To Get Started Right – TIPS

P = Payroll

Now I Have Tons of Work Rolling In and I’m Ready to Hire My FIRST Employee! I have found the perfect person - My friend! We been buddies for a long time and we are going to have a Blast working together. Here’s where I immediately think of the robot in “Lost In Space” saying “Warning Will Robinson”.

Why The Caution? – Because having an employee is different than when it’s just you meeting the client, doing the work, collecting the money. The dynamics change when you hire that outside person. You need to be even more cautious when you are considering hiring a friend or family member instead of a stranger because success has a thousand fathers while failure is an orphan! Success or failure could mean having to choose between peace and harmony in your personal relationships or giving away a portion of your hard earned success.

Why Worry? – Because even with the best of intentions by everyone involved only a percentage of friendships survive the employee / employer experience.

Working together every day is not the same has having a good time at the park on the weekend, at the game, fishing on the river or hundreds of other fun stuff. Chat about how it will be. Everyone has a set of expectations about what is right and fair and it is better to have an understanding before you get in the deep water.

The Owner Of The Business Is “The Owner” and the final responsibility falls on that person. “The Friend” is an Employee – with all the rights of an employee. Prospective applicants need to complete a formal employment application and complete the hiring process before going to work on the job.

P = Planning

People Don’t Plan To Fail – They Fail To Plan

Hiring an employee has added benefit of them doing part / all of the production.

That is the Upside. The Downside is there are additional costs for Labor / Taxes / Overhead that comes with the hiring of any employee. You need to understand “What 10 Minutes is Costing Your Company?”

Check – Recheck! Time to review your numbers - Have you been working for FREE? These additional labor costs should already be factored into your bids

In some cases employees are entitled to Washington State Unemployment benefits if they are no longer working for you or worker compensation. If they are unemployed due to an injury it could get real interesting.

- Have you opened accounts with Washington State Department of Employment Security / Washington State Department of Labor & Industries

- Determine what rate a pay you are offering - Must Be Minimum Wage

- What is your pay schedule? Weekly / Bi-Weekly / Semi-Monthly / Monthly

- Do you have a paper or electronic timecard? It needs to be filled out daily.

- Are you paying the employee’s paycheck via check or direct deposit?

- Plan to Interview several applicants (practice)

P = Production

Congratulations – Your “To Do List” is done! You ready to start the next job.

Your new employee is ready willing and able to begin work as you laid the work out for them. They have all of the ladders / power tools / hand tools needed to “Get Busy”. With lots of preplanning this arrangement can be very successful. One of the areas we assist with is the payroll processing.

P= Profit

The goal is to make a profit. One of the ways to do that is leveraging your time.

- How do I do that?

- Understand and use the 80/20 Rule

- Hire employees as needed

- Use our M.A.P. Strategy Click Here To Learn More

- Hire an outside accounting service such as Fast Easy Accounting

- People ask how we save them time and money on Bookkeeping - Click Here for the answer!

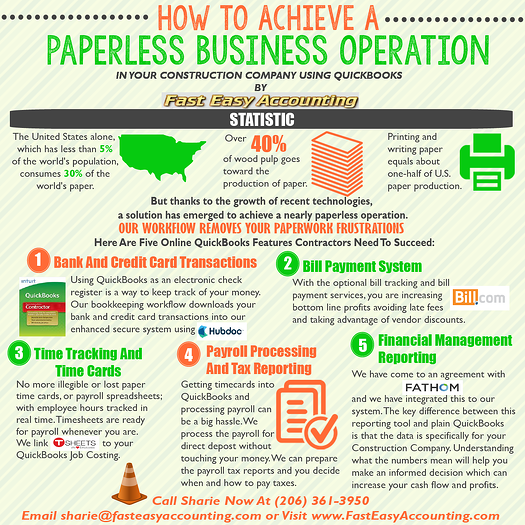

Paper can easily be over handled and it cost money! For the owner each piece of paper has a story and it is a recap of something or everything about the job. It is contained in that little piece of paper. To us it is just a piece of paper. The amount could be one dollar; ten dollars; one hundred dollars; one thousand dollars and it will have the same emotional impact; zero!

You Make Money Doing “The Stuff You Do So Well” We Are Your Support Group So You Can Focus On What Do What You Do Best!

Clients Have Gleefully Dropped Off Paperwork And Their Way To “Go Fishing” / “Gone On A Motorcycle Ride” / “Take The Motorhome Out” …Are You Seeing A Theme? We Are Here To Help You Have A Life.

You Have Time

- To Be Doing Something Else!

- Whatever It Is You Do Best!

- Or Just Want To Do!

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

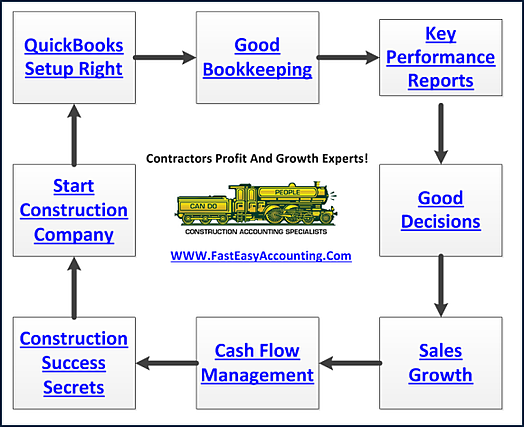

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/