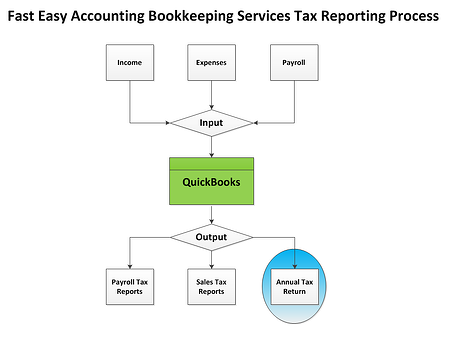

Your Tax Bill Is Based On Reports From Your QuickBooks Construction Accounting System

QuickBooks For A Tiny Company - But not any construction company, can be setup and maintained by just about anyone who can fog a mirror. Setting Up QuickBooks and Maintaining QuickBooks for a construction company is a whole different thing. It is the difference between flying a tiny remote control toy plane at the park on a sunny afternoon and piloting a Boeing 787 jetliner with your company and everyone depending on it aboard.

Most Data Entry In QuickBooks - Is routine and boring, just like most of the time in the cockpit flying a Boeing 787 jetliner is boring and routine. The problem is when the standard bookkeeper comes across a complex transaction that is like piloting the Boeing 787 jetliner into a category five hurricane, sheer terror!

Garbage In = Garbage Out - If you have one of those bookkeepers who took a one day seminar, watched some videos, took an online class, spent a few months working in an accounting firm or is self-taught and believes in learning by experience (this means when they make a mistake you get to pay for it) then you almost certainly are paying a whole lot more in taxes than you should.

We Know These People - Very well because we have repaired, rebuilt, overhauled, done major treatment procedures on and pulled a lot of wrecked construction company QuickBooks files out of the ditch where they were wrecked!

10,000 Hours Of Practice Are Required - To master a skill according to Malcolm Gladwell the author of the book "Outlier". He book has examples like the Beatles playing nearly 10,000 hours together in Germany before the emerged as "The Beatles", Tiger Woods invested 10,000 hours on the golf course before he turned 21, Bill Gates as a kid put in 10,000 on his PC...and so it is...

Professional Bookkeepers - Are people who have invested at least 10,000 hours in practicing and learning their trade because that is what it takes to be a Master Construction Accounting And Bookkeeping Services Specialist at Fast Easy Accounting!

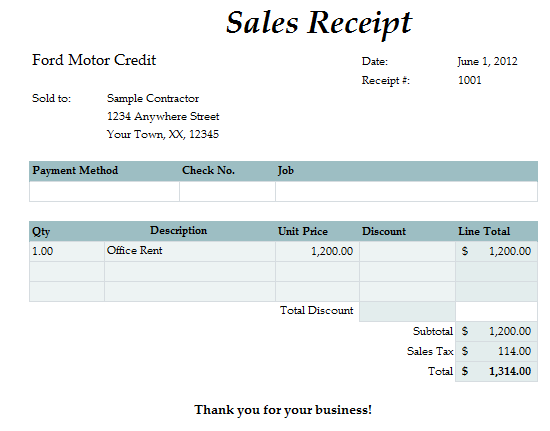

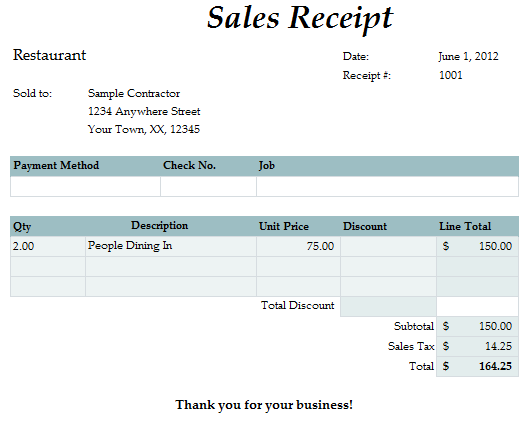

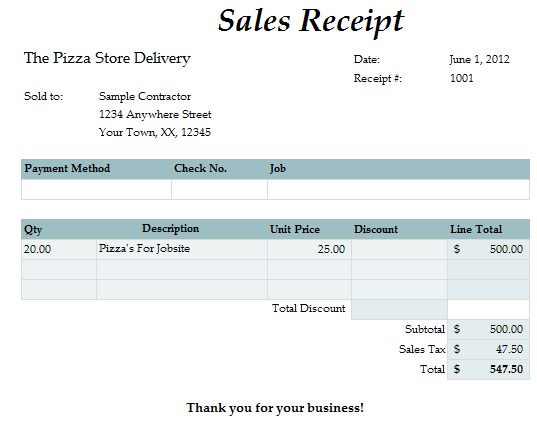

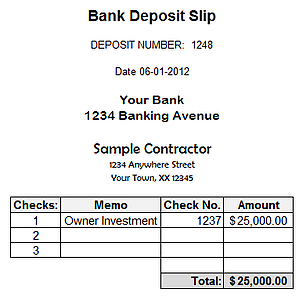

Putting Receipts - Inside QuickBooks is easy! Putting them in the right account so the reports are accurate, the business owner can trust them and when the taxes are filed you will pay the least amount possible that is where the professional bookkeeper earns their money.

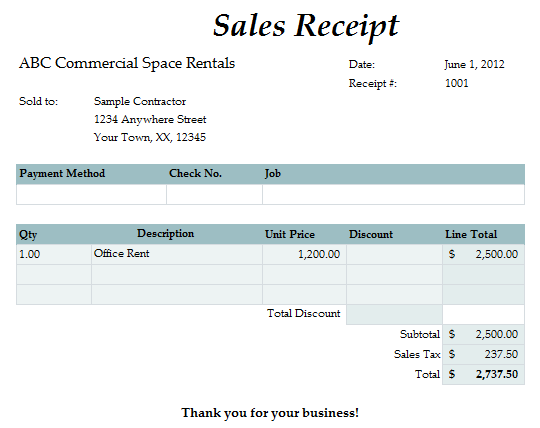

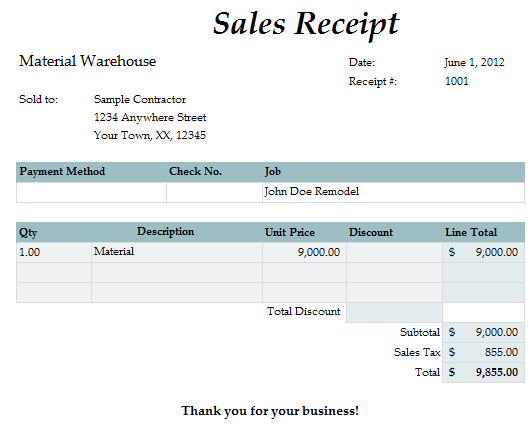

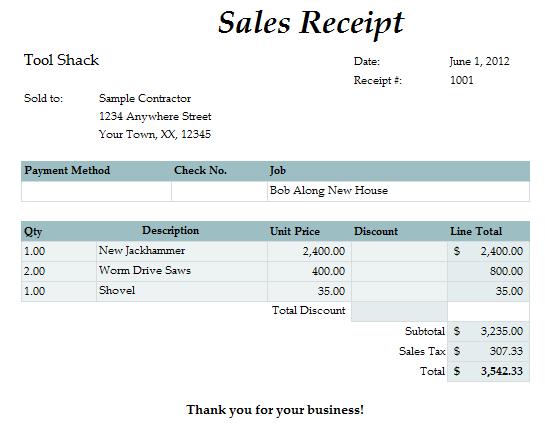

For Example Look At The Following Receipts:

If Your Bookkeeper - Put all those receipts in as expenses you could be overpaying your taxes by at least $5,000 and probably more.

If You Think Your Tax Preparer - Will catch the bookkeeping errors think again! That is not what they are paid to do! Most of them are paid on commission to prepare as many tax returns as fast as possible! Which means most of them will not spend the time and effort to review the details of hundreds or thousands of transactions to make sure the amounts have been put in the right accounts. Read More...

Summary: You work hard for your money and if you are having cash flow problems you could be paying too much in state, Federal and local taxes. Contact Sharie 206-361-3950 or by email at sharie@fasteasyaccounting.com for a no charge one hour consultation to find out if we can help you lower your tax bill and in some cases help you get a refund on past tax returns that have already been filed.

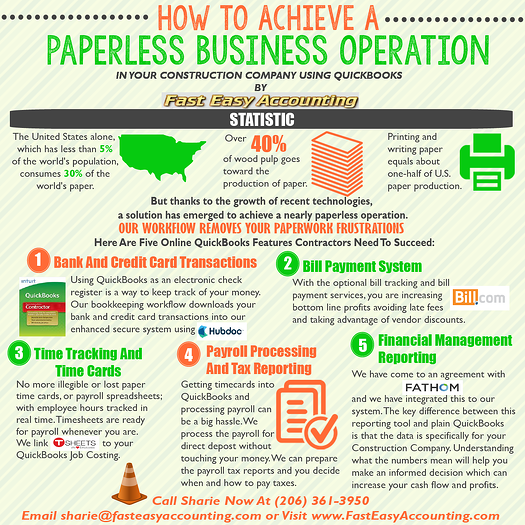

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

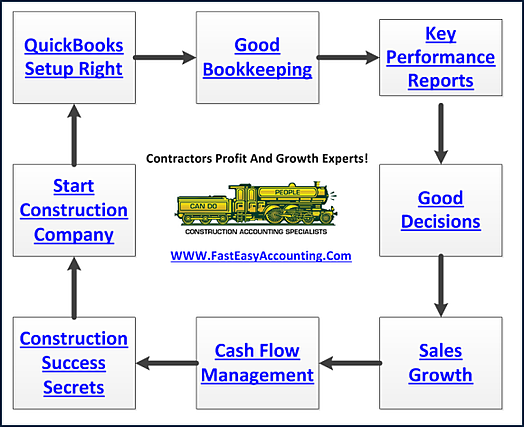

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+