Frequently Asked Questions About Outsourced Contractors Bookkeeping Services

Contractors Bookkeeping Services Questions

Do you have something I can download and read?

Where Is The Contractors Bookeeping And Accounting Done?

Will I lose control of my company?

Can other people access my data?

Do you provide audit and tax services?

How much does your service cost?

What part of The U.S.A. do you service?

How do I get paperwork to you?

What construction accounting software do you support?

Why don't you support other accounting software?

QuickBooks For Contractors Questions

Which QuickBooks do you support?

My QuickBooks is a mess can you fix it?

Do you repair QuickBooks for construction?

Can I get financial reports without opening QuickBooks?

Do you setup QuickBooks for construction?

Can you convert QuickBooks to other versions?

Can you convert QuickBooks Enterprise to Pro or Premier?

Which QuickBooks is best for my construction company?

Can I access QuickBooks desktop version securely in the cloud?

Consulting Services For Contractors Questions

What is M.A.P. and how can it help me and my Contracting Company?

I Need A Good Business Plan That Is Fast, Easy And Inexpensive, Can You Help?

Xero Accounting Online For Contractors Questions

Do you support Xero Accounting Online For Construction?

Do you repair Xero Accounting Online For Construction?

Do you setup Xero Accounting Online For Construction?

Bill.Com For Contractors Questions

Do you support Bill.Com for construction contractors?

TSheets.Com For Contractors Questions

Do you support TSheets for Construction contractors?

Do you setup TSheets for Construction contractors?

Does TSheets work with smartphones and iPhones?

Does TSheets link to QuickBooks?

Will TSheets help with QuickBooks Job Costing Reports?

Answers Start Below The Line

---------------------------------------------------------------------------------------------------------------Do you have a Podcast?

Yes! You can listen on iTunes, Stitcher and several other media outlets. Click on the images below:

Contractors Bookkeeping Services Answers

Do you have something I can download and read?

Yes! We have two FREE Bookkeeping Guides that are very popular.

One is for construction company owners that are considering hiring an in-house construction bookkeeper. It has a lot of detail regarding some of the things to watch out for to hopefully avoid hiring a Bad Bookkeeper that will destroy your construction company and an in-depth analysis with suggested hardware, software and office equipment as well as some overview of the system you will need to put in place in order to get the most out of your in-house construction bookkeeper. Click on the button below to download it.

The other one is for construction company owners who want an in-depth analysis of the psychological profiles of our Professional Construction Bookkeeping staff with some of the hardware, software and office equipment we use. It includes a brief overview of our outsourced contractors bookkeeping system that allows us to service a number of combinations of construction companies including:

One Income Contractors:

-

Handyman Services

-

General Contractors

-

Residential Remodel Contractors

-

Commercial Tenant Improvement Contractors

-

Spec Home Builders

-

Custom Home Builders

-

Land Developers

-

Sub-Contractors

-

Specialty-Contractors

-

Flipper House Contractors

Multiple Income Contractors:

-

Handyman + General + Remodel

-

Residential Remodel + Commercial Tenant Improvement

-

Spec Home Builders + Residential Remodel + Land Developers

-

Custom Home Builders + Spec Home Builders + Residential Remodel + Land Developers

-

Any Combination With An Inventory Of Rental Properties

Click on the button below to download it.

Where Is The Contractors Bookkeeping And Accounting Done?

Everything is done at our headquarters at in Lynnwood Washington. We have a team of qualified construction bookkeepers, construction accountants and support staff. Everyone understands the importance of maintaining the integrity of your data and nothing is sent out.

Will I lose control of my company by outsourcing my contractors bookkeeping?

Absolutely not! You maintain 100% control of all the decisions and all checks are signed by you. We do not touch your money. You decide who gets paid, when and how much they are paid. We provide you with the list of payables and record the transactions, but you approve all invoices for payment and sign all checks and control your credit cards.

What about security?

Right now if you are like most construction contractors your construction accounting records are in an unlocked file cabinet or worse, sitting on someone's desk. We take security very serious and are constantly looking at our systems. We utilize 128-bit SSL encryption which enables clients to verify authenticity and to securely communicate with our servers. In order to get your data file there are 2 levels of restrictions and passwords that must be successfully entered.

We only use Intuit Approved Commercial Hosting Services. We have taken steps to select the best of the best Intuit Approved Commercial Hosting Service to ensure that your data is as secure as that found for online banking and financial institutions.

Their Cloud Security rests on U.S. based servers, backups, data centers and technical support. Not one aspect of our Cloud security relies on outsourced services or offshore locations.

Automatic nightly backups are kept for a minimum of 30 days, and our Private Virtual Server clients have the option to increase these backups to be performed more frequently or kept on longer data retention schedules.

Encrypted Access

Each time any user logs into the system to access data it is thru 256-bit encryption, offering you peace of mind in the security of your transfer. With the same security as Online Banking, your data could not be safer.

Simply stated, the Intuit Approved Commercial Hosting Service we use is first and foremost a cloud security company, delivering multiple layers of protection, from our state-of-the art physical data center all the way across to your database, software applications, and data files.

Their mission to ensure your cloud server security and protection against cybercrime or technical malfunction stems from the belief that cloud computing security is never an element that would simply be added-on to a resource infrastructure.

At Fast Easy Accounting, Cloud Security is not an option - it is a fundamental requirement.

Standard Cloud Computing Security Features of their CERTIFIED SOC2/SSAE16 data center includes:

-

12+ Megawatts of uninterrupted power

-

Cisco Firewalls and Routers

-

Mirror Disk Imaging

-

RAID implementation

-

N+1/2N or better Redundancy

-

Biometric hand scanner

-

CCTV Digital Surveillance

-

Motion Detection on all data center floors

-

Seamless private Layer 2 transport

-

24/7/365 Onsite Monitoring

We do not name the service we use since the technology is continually evolving and upgrading and when we feel it is time to move to another Intuit Approved Commercial Hosting Service we do it.

We have used several of the largest and highest rated Intuit Approved Commercial Hosting Services and have found they all have good and bad points. The one thing to keep in mind is that none of them are "Plug and Play" which is why we have staff members who are qualified in database structure and access to local computer networking technicians when we need a higher level of skill.

Using a hosted service for accessing QuickBooks desktop online is mission critical to being able to provide reliable and professional grade outsourced contractors bookkeeping services for construction contractors all across the U.S.A. This is one area where price is not even in the top ten things we consider when selecting an Intuit Approved Commercial Hosting Service.

Can other people access my data?

No one can have access to your data without your company's express permission; this includes your CPA, advisors and specific employees. We can also set up restrictions so that certain functions can be limited to those you do allow access.

Do you provide audit and tax services?

We focus on doing one thing and doing it right, outsourced construction accounting services. We can process payroll and prepare Quarterly Tax Returns; however, we do not perform audits, reviews, and compilations or provide opinions on your financial statements. We will assist and coordinate these functions with your current CPA to ensure that they have the necessary information to prepare these for you.

Still have questions? We invite you to Contact Us or request a Free One Hour Consultation.

Do you replace my C.P.A.?

No! Absolutely Not! Your current CPA should be a contributing member of your Board of Advisors helping you to get the most out of your construction company.

We perform contractors bookkeeping services only and work with your current CPA. Since we do not perform tax or attest services, your CPA does not need to be concerned that we are here to replace them. We value your relationship with your CPA and look to enhance the day to day record keeping so your CPA can help you make informed decisions.

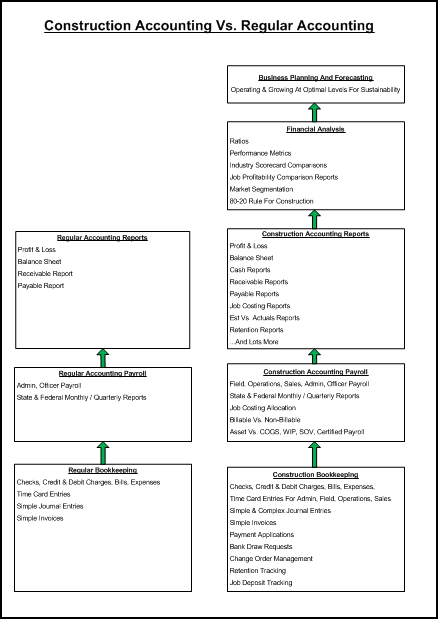

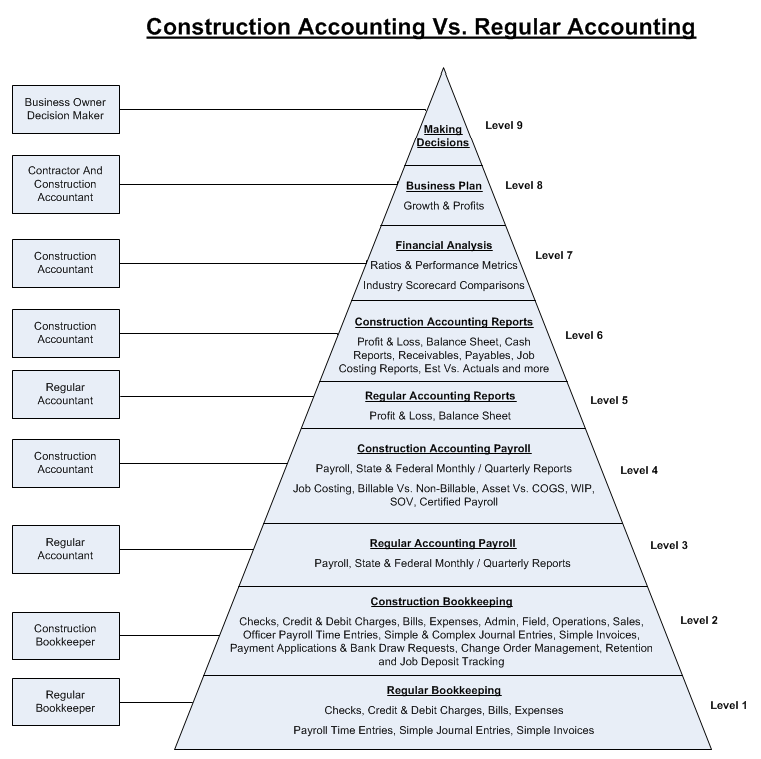

We help eliminate the frustration that can arise between the CPA and the clients due to inadequate contractors bookkeeping services because of the vast differences between Regular Accounting and Construction Accounting.

Regular Accounting is concerned with the basic financial reports which are used for preparing annual tax returns and some very rudimentary management decisions:

Construction Accounting is built upon regular accounting and shares the same basic financial reports and a number of other reports which contractors use to operate and grow their construction companies and know which jobs to pursue and which ones to let go.

Can my C.P.A access my contractors bookkeeping services on-line?

Only if you give them your user name and password! For regular accounting it is not so bad if your C.P.A. has access to your data. For construction companies we have found most of them do more harm than good because they are not trained in construction accounting.

This same thing applies for why it is a bad idea to give your outsourced construction accounting services access to your C.P.A.'s tax preparation software. In fact I am not aware of anyone who would give access to their tax preparation software.

Anytime your C.P.A. or any other financial adviser needs to see reports you can contact Sharie at 206-361-3950 or sharie@fasteasyaccounting.com and we will be happy to provide them.

Who will service my account?

You will be assigned a contractor champion. This is someone who understands your specific type of construction work and our contractors bookkeeping services system. This person will be your guide, mentor and friend. They are your advocate to make certain you are provided the best possible service and they have the authority to assign resources in the event of an emergency construction accounting situation such as special reports, quarterly tax reports, insurance audits and complex payment applications. They also monitor the quality and quantity of reports, emails, graphs and other data to make certain you are getting the right amount of information without overwhelming you with useless reports and notifications.

Most accounting firms do not have a system and operate in complete chaos by assigning each bookkeeper the maximum number of clients humanly possible and hope nothing goes wrong. It is similar to putting all your eggs in one basket and hoping nothing happens to them!

Human Nature Being What It Is Eventually:

-

Your bookkeeper will get sick

-

Your bookkeeper will get overworked

-

Your bookkeeper will quit or get fired

-

Your bookkeeper will take a long vacation

-

Your bookkeeper will have too many clients

-

Your bookkeeper will get another bookkeeper's clients

-

Your bookkeeper may become a burned out Bad Bookkeeper

We Are Process Dependent, Not People Dependent

Your day to day contractors bookkeeping services is safe and it will be assigned a team of skilled Professional Construction Bookkeepers and Accountants with several levels of construction accounting skills and an internal support system that conducts regular reviews of every contractors bookkeeping system.

How much does your service cost?

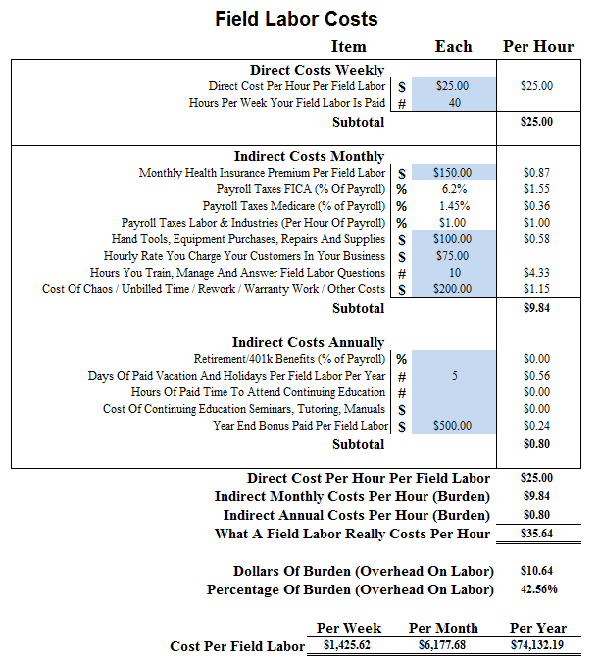

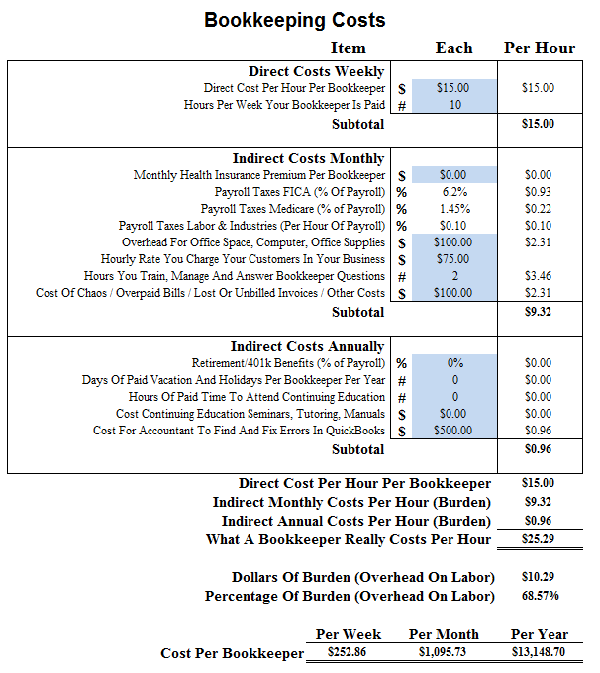

In general, our costs are 40% less than our clients were paying for their accounting staff with at least double the accuracy plus the savings in not overpaying taxes. Our fees are based on the volume and complexity of each client. We determine the scope of services and establish a fixed monthly amount so you can manage you budget.

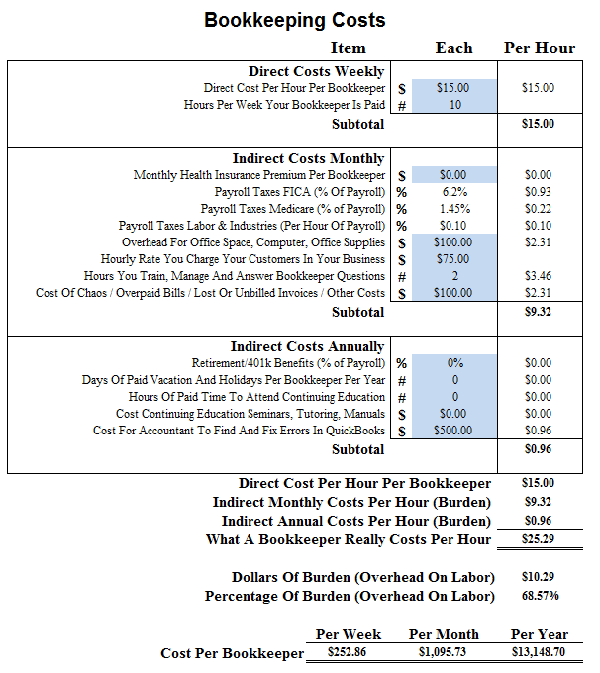

For example if you have a part-time bookkeeper paid $15.00 per hour working 10 hours per week your fully burdened labor costs will be roughly $25.29 per hour or roughly $1095.73 a month. Generally we can do the same amount of work for 40% less!

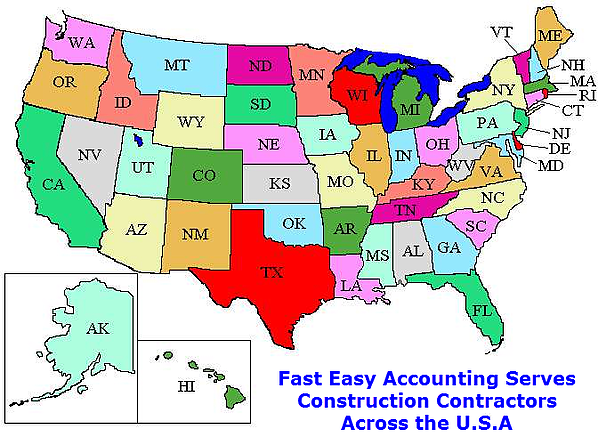

What part of The U.S.A. do you service?

All 50 States all across the U.S.A. including Alaska and Hawaii. We work best with Construction and related industries from new start-up construction companies to those who have been in it for a lifetime and preferably with annual sales volumes ranging from $0 to $10M. Everything hosted in secure servers online which means working with us is Fast And Easy!

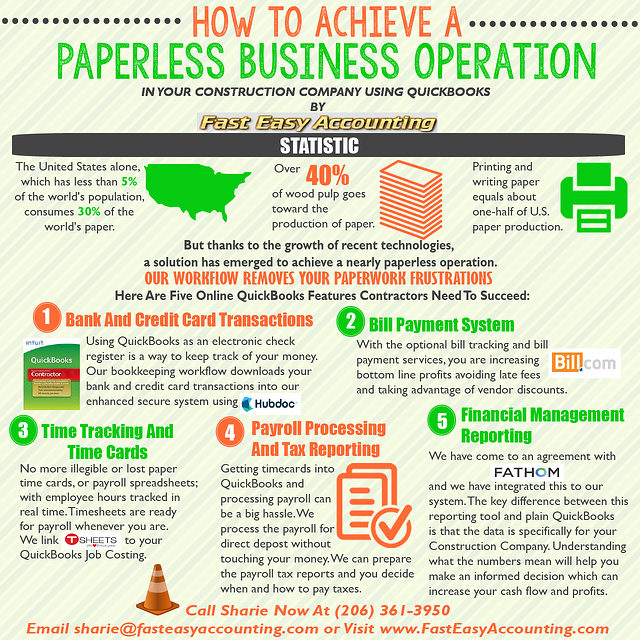

How do I get paperwork to you?

Whatever way is easiest and best for you. You can bring it to our office, ship hard copy, USPS, fax, FedEx, UPS, soft copy, scanned, emailed, smartphone images, iPhone images, shoe box, file box, any box, bags, Google docs, drop box any way that works for you we can handle it. Your Contractor Champion will work with you to determine what works best for you.

You don't need to organize for us because we have a system from having owned and operated several construction companies in the past, we are not pansy construction bookkeepers that need to be pampered and are easily offended; quite the opposite.

We have a Construction Bookkeeping Services System - With workflow processes for everything including paper sorting. Which means once it arrives no matter how organized or disorganized it is we need to pre-process everything before it enters our workflow where it is scanned and uploaded into paperless servers in the cloud? Hopefully you not having to sort anything will save you time and money.

We prefer you not sort anything because it will save everybody time and money. You can put it all in a bag, box, ox cart or whatever works for you and bring it in. You can fax it, email it or scan it into our paperless server, again whatever works for you!

We scan your receipts and invoices link them to QuickBooks transactions where it is appropriate and give you back a CPA-ready packet for your tax return. And we provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Construction paperwork is like a brand new apprentice construction worker; left unattended it tends to wander off and get lost so here are a few helpful hints where paperwork hides:

In The Contractors Mobile Construction Office Command Center, The Truck:

-

On the dashboard

-

Behind the seat

-

Under the seat

-

In the console between the seats

-

In the glove box

-

Under the spare tire

-

In the box you got from the supplier warehouse

Outside Your Mobile Office:

-

In you post office box

-

Stuffed in manila envelopes

-

On the night stand

-

Piled on your desk

-

In your wallet

-

Inside your portfolio

-

Stuffed in all your pants pockets

-

In your computer bag

-

Stuffed in all your shirt pockets

Coffee Stained Paperwork Is Optional - We prefer a dark roast, double foam, shot of mint, with a hint of cinnamon. However, plain old black coffee is O.K. too!

Do Not Be Concerned - Where the paperwork has been, when we owned and operated our plumbing service, repair and drain cleaning company we had seven trucks and over twenty employees. We processed paperwork that had been places you can only imagine with no problems at all.

In Summary Don't Sort The paper - Get a big box, file box, and scoop it all into the box, close the box, bring us the box. To you, the contractor, every piece of paper has a story.

This Means Every Time You - Touch it, see it, sort it, smell it, put it into QuickBooks for Contractors or just look at it your protective conditioned mind and its fear creating mechanisms will replay the entire story which will slow you down and in turn drag out the entire construction bookkeeping process. Furthermore it could possibly release serotonin which causes the blood vessels in your head to contract and lower your pain threshold.

It Is A Fact - Doing something you don't like or understand like construction bookkeeping can be painful and in the end when you try to "Power Through The Pain" like Olympic athletes you end up losing money because after powering through the pain you typically do not have the luxury of a vacation and rest period you have to go see that next customer, close the next sale or manage the next job and when you are not at your peak performance you lose, big time!

Your Contractors Bookkeeping Paperwork Has Already - Been over handled, we do not have any emotional attachment to it which means we can reduce input time by at least 40% and since we pass the savings on to you everybody wins.

Profitable Construction - Companies have known about and outsourced bookkeeping for a long time and now you know about it too!

Optional One Button Scanner Sends Paperwork To Us

What construction accounting software do you support?

QuickBooks or Xero Accounting Online for construction depends on how you get paid, the type of work your company does and if you need Job Costing.

QuickBooks Works Best If You:

-

Takes Job Deposits

-

Have Change Orders

-

Issues Multiple Invoices

-

Need Work-In-Progress

-

Need Job Costing Reports

-

Need Payment Applications

-

Need Periodic Invoices For Bank draws

-

Need Complex Construction Accounting Reports

At The Price Point Intuit Offers All Versions Of QuickBooks including QuickBooks Pro, QuickBooks For Contractors and QuickBooks For Contractors Enterprise no other construction accounting software comes close too offering the robust Job Costing Reports, Work-In-Progress Reports And Tracking (WIP) and hundreds of other combined reports and features medium and large contractors need in order to operate and grow their construction company.

We Are Raving Fans Of Intuit the makers of QuickBooks and have used QuickBooks since the first version was released in 1992. In fact in 2005 we moved our entire client base including our own accounting firm's QuickBooks files to an Intuit Approved commercial hosting environment so we could offer our clients all of the benefits of the full desktop version of QuickBooks accessible online 24/7 and it has been a huge success!

Xero Accounting Online Works Best If You:

-

Need To Get Paid Faster And Easier

-

Have Simple Jobs You Invoice Individually

-

Need To Invoice Customers At The Jobsite

-

Need Key Performance Indicator Financial Reports

-

Want Professional Construction Accounting At Lower Costs

All versions of QuickBooks including QuickBooks Pro, QuickBooks For Contractors and QuickBooks For Contractors Enterprise is very inexpensive compared to other construction accounting software when it comes too Job Costing Reports, Work-In-Progress Reports And Tracking (WIP) and hundreds of other combined reports and features medium and large contractors need in order to operate and grow their construction company.

Why don't you support QuickBooks Online, Wave, Freshbooks and Peachtree?

All accounting software packages have an audience and can be made to work for companies that need simple regular accounting. We specialize in construction accounting which is a much higher level of accounting. Regular accounting provides the foundation for basic Financial Reports such as Profit & Loss and Balance Sheet which are used by tax preparers for the annual tax return.

Construction accounting is built on regular accounting and shares the same basic financial reports for operating and growing a business and preparing annual tax returns and some very rudimentary management decisions. Construction accounting adds many complex layers of reporting mechanisms to show the contractor where their best customers and clients are within psychographic and geographic market segmentation boundaries.

For more details click on Construction Accounting Vs. Regular Accounting

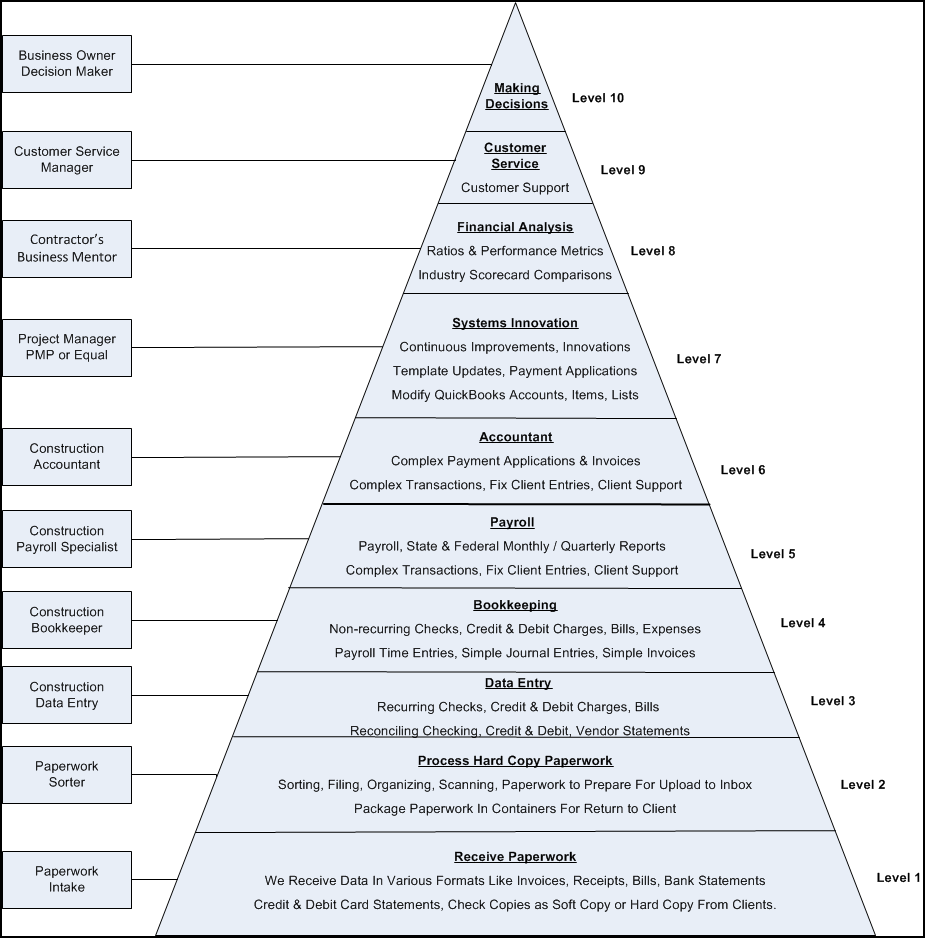

Below Are Two Diagrams For Construction Accounting Vs. Regular Accounting

QuickBooks For Contractors Answers

Which QuickBooks do you support?

For remote hosting of QuickBooks Desktop Pro, Premier and Enterprise we support the last three years.

For earlier versions of QuickBooks including QuickBooks Mac we support 2004 to the current year.

QuickBooks setup (simple, custom, contractor, home builder, land developer, commercial tenant improvement, flipper house, service & repair and more.

QuickBooks clean-up, QuickBooks repair, QuickBooks emergency services.

My QuickBooks is a mess can you fix it?

Yes! We have been working with QuickBooks from the very first release in DOS in 1992. With over 100,000 man hours of combined experience we have seen just about everything.

We maintain and regularly update the most extensive collection of diagnostic software and database manipulation software tools designed specifically to work with messed up and broken QuickBooks files.

If your QuickBooks needs help we can help 206-361-3950 or sharie@fasteasyaccounting.com

We service over 1,000 construction and construction related companies. Just a few examples below:

QuickBooks Repair:

-

QuickBooks Repair For General Construction

-

QuickBooks Repair For Commercial Tenant Improvement

-

QuickBooks Repair For Spec Home Builders

-

QuickBooks Repair For Custom Home Builders

-

QuickBooks Repair For Land Developers

-

QuickBooks Repair For Specialty Contractors

-

QuickBooks Repair For Sub-Contractors

-

QuickBooks Repair For Professionals

-

QuickBooks Repair For Architects

-

QuickBooks Repair For Engineers

QuickBooks Clean-Up:

-

QuickBooks Clean-Up For General Construction

-

QuickBooks Clean-Up For Commercial Tenant Improvement

-

QuickBooks Clean-Up For Spec Home Builders

-

QuickBooks Clean-Up For Custom Home Builders

-

QuickBooks Clean-Up For Land Developers

-

QuickBooks Clean-Up For Specialty Contractors

-

QuickBooks Clean-Up For Sub-Contractors

-

QuickBooks Clean-Up For Professionals

-

QuickBooks Clean-Up For Architects

-

QuickBooks Clean-Up For Engineers

QuickBooks Tune-Up:

-

QuickBooks Tune-Up For General Construction

-

QuickBooks Tune-Up For Commercial Tenant Improvement

-

QuickBooks Tune-Up For Spec Home Builders

-

QuickBooks Tune-Up For Custom Home Builders

-

QuickBooks Tune-Up For Land Developers

-

QuickBooks Tune-Up For Specialty Contractors

-

QuickBooks Tune-Up For Sub-Contractors

-

QuickBooks Tune-Up For Professionals

-

QuickBooks Tune-Up For Architects

-

QuickBooks Tune-Up For Engineers

Do you repair QuickBooks for Construction?

Yes! For all versions and years of QuickBooks including QuickBooks Mac starting with 2003 through the current year. It is far cheaper and more effective than having your CPA fix your QuickBooks and correct it during tax season. It only makes sense to subcontract it out to professional construction accountants who have done it thousands of time and have a process in place to see to it that it gets done right.

In addition to the benefits of having accurate and useful reporting during the year can help you make better and more informed decisions in all aspects of running your construction company.

Can I get financial reports without opening QuickBooks?

Yes, we can lease it for you and keep it on our remote Intuit Approved Commercial Hosting service provider and provide you with 24/7 online access to your financial reports. You never have to open QuickBooks or mess with it at all!

The Short Video Below Tells The Whole Story

Do you setup QuickBooks for Construction?

Yes we offer custom QuickBooks setup for all versions and years of QuickBooks including QuickBooks Mac starting with 2003 through the current year. We have templates designed for all different types of construction including commercial, residential, spec home builders and service / repair contractors. With or without Job Costing Reports.

Since the cost of properly setting your books up and maintaining them is far cheaper and more effective than having your CPA fix and correct it during tax season it makes sense to subcontract it out to professional construction accountants who have done it thousands of time and have a process in place to see to it that it gets done right.

In addition to the benefits of having accurate and useful reporting during the year can help you make better and more informed decisions in all aspects of running your construction company.

QuickBooks Setup Examples:

-

QuickBooks Setup For General Construction

-

QuickBooks Setup For Commercial Tenant Improvement

-

QuickBooks Setup For Spec Home Builders

-

QuickBooks Setup For Custom Home Builders

-

QuickBooks Setup For Land Developers

-

QuickBooks Setup For Specialty Contractors

-

QuickBooks Setup For Sub-Contractors

-

QuickBooks Setup For Professionals

-

QuickBooks Setup For Architects

-

QuickBooks Setup For Engineers

If you do not see your particular need here please contact Sharie 206-361-3950 or sharie@fasteasyaccounting.com

Can you convert QuickBooks to other versions?

Yes! We convert any QuickBooks file from QuickBooks 2000 to the current year to the same year of QuickBooks Pro or QuickBooks Premier from 2003 to the current year. QuickBooks Enterprise it is limited to 2003 to the current year.

In some cases we can even convert a newer QuickBooks to an older QuickBooks. For example we can convert QuickBooks Enterprise 14 (2014) to QuickBooks Pro or Premier 2013.

Other examples include:

-

QuickBooks Enterprise to Pro or Premier

-

QuickBooks Online to Pro, Premier or Enterprise

-

QuickBooks Enterprise to Pro, Premier or QuickBooks online

-

QuickBooks Enterprise, Pro or Premier to Xero Accounting Online

-

Quicken to QuickBooks Pro, Premier or Enterprise

-

Quicken to QuickBooks Pro or Premier

-

QuickBooks Mac to Windows Pro, Premier or Enterprise

Can you convert QuickBooks Enterprise to Pro or Premier?

Yes! We convert QuickBooks Enterprise file from QuickBooks 2003 to the current year to the same year of QuickBooks Pro or QuickBooks Premier from 2003 to the current year.

In some cases we can even convert a newer QuickBooks Enterprise to an older QuickBooks Pro or Premier. For example we can convert QuickBooks Enterprise 14 (2014) to QuickBooks Pro or Premier 2013.

Other examples include:

-

QuickBooks Enterprise to Pro or Premier

-

QuickBooks Online to Pro, Premier or Enterprise

-

QuickBooks Enterprise to Pro, Premier or QuickBooks online

-

QuickBooks Enterprise, Pro or Premier to Xero Accounting Online

-

Quicken to QuickBooks Pro, Premier or Enterprise

-

Quicken to QuickBooks Pro or Premier

-

QuickBooks Mac to Windows Pro, Premier or Enterprise

Which QuickBooks is best for my construction company?

QuickBooks Pro - Is great for contractors acting as Sole Proprietor with annual sales under $100,000 who simply need a way to keep track of basic income and expenses. You can set it up really basic and simple to do most everything in the check register. When you spend money record it in the check register as an expense and when you receive money record it as income. When it is time to file the taxes you generate a Profit & Loss and Balance Sheet and give it to the person that fills out your annual tax returns.

QuickBooks Premier Contractors Edition - Is designed for serious contractors with annual sales above $100,000 because those companies are usually setup as a corporation, Sub-S or LLC in order to reduce the high income tax they would pay if they were a Sole Proprietor. In addition to the fact that having a corporation can help protect your personal assets, home, car, savings.

QuickBooks - Is an accounting tool like any other tool in the hands of a Master Construction Accountant it can do marvelous things that will amaze even the toughest contractor, their banker and performance bonding agent. However, in the hands of the average bookkeeper it can cause severe and long lasting damage. In the hands of an accountant or C.P.A. it can destroy your construction company. Construction accounting is not something that can be learned; it must be experienced, first hand, as a construction worker on the jobsite before it can be understood. Then and only then is someone prepared to learn it. A Master Construction Accountant can develop a construction bookkeeping and accounting firm with a comprehensive bookkeeping system like an assembly line and hire Professional Bookkeepers to run it.

The most important reason to use QuickBooks Premier Contractors Edition is it helps construction contractors understand the financial health of their construction company. QuickBooks Premier Contractors Edition provides a running scorecard of Key Performance Reports and when used with Business Process Management Tools like what 10 minutes of waste costs their company.

Five Types Of Construction Firms And They Can All Use QuickBooks Premier Contractor Edition Effectively:

Type I - New Construction Speculative land developers, home builders and light commercial builders. These are the contractors who build something in hopes a buyer will emerge during or shortly after the building is built

-

You use QuickBooks to track all your construction and overhead costs and generate Bank Draws and Work-In-Progress (WIP) reports against budgeted estimates to monitor progress which we have in our QuickBooks Setup.

-

Your Chart of Accounts needs to be focused WIP Assets with a few Cost of Goods Sold Accounts (COGS) to allocate the sale of the building

-

You need the Five Key Performance Indicators (KPI) to monitor the financial health of your business

-

You need QuickBooks setup to have between 200 and 6,000 Items setup to track all the costs of the construction process from the ground up through the roof and final cleanup

-

This is the most difficult QuickBooks setup is the Premier Contractor Edition because there is a mix of Direct, Indirect, Asset, WIP and COGS accounts

-

The day to day input is also the most difficult and needs to be handled by construction accounting staff with specialized training in construction accounting

-

Your income can be sporadic and extremely sensitive to the ups and downs of the new construction market which is why you need a strategy with an external focus on the global housing market.

-

In order for your Spec Builder Company to reach its full potential you will need an overall strategy including a Business Plan for Contractors

-

We believe a lot of speculative builders go bankrupt because they do not have accurate QuickBooks reports to base decisions on and that is as direct result of trying to save money with Cheap Bookkeeping

Type II - New Construction Custom Home Builders residential and light commercial buildings who build something specific for a client.

-

You have QuickBooks setup to track all the costs and generate Complex Payment Applications, Item Estimates vs. Actuals, Job Profitability Summary and Job Profitability Detail Reports to monitor progress.

-

Your QuickBooks setup needs to have Chart of Accounts with proper Goods Sold Accounts (COGS) to allocate project costs.

-

You will benefit from the Five Key Performance Indicators (KPI) to monitor the financial health of your business

-

Your QuickBooks setup will have between 500 to 2,500 Items to track all the costs of the construction process from the ground up through the roof and final cleanup

-

This is the second most difficult QuickBooks setup, the Premier Contractor Edition because there is a mix of Direct, Indirect, COGS and only a few WIP accounts

-

The day to day accounting and bookkeeping input is the second most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

Our experience has been your group generates a relatively unstable income and is somewhat sensitive to the ups and downs of the new construction custom built market

-

In order for your Custom Home Building Company to reach its full potential you need a Construction Business Strategy including a Business Plan for Contractors

-

We believe a lot of custom builders go bankrupt because they do not have accurate reports to base decisions on and that is as direct result of trying to save money with Cheap Bookkeeping

Type III - Remodel Contractors both residential and commercial tenant improvement contractors.

-

You use QuickBooks to track all the costs and generate Complex Payment Applications Item Estimates vs. Actuals, Job Profitability Summary and Job Profitability Detail Reports to monitor progress.

-

Your QuickBooks setup Chart of Accounts is focused Goods Sold Accounts (COGS) to allocate project costs.

-

You need the Five Key Performance Indicators (KPI) to monitor the financial health of the business

-

Your QuickBooks setup will need 1,000 to 5,000 Items to properly track all the costs of the construction process from beginning to end in order to get the reports you need

-

This is the third most difficult QuickBooks setup is the Premier Contractor Edition because there is a mix of Direct, Indirect, COGS and only a few WIP accounts

-

The day to day input is also the second most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

Our experience has been your group generates a stable income and is not as sensitive to the ups and downs of the new construction market

-

In order for you to reach their full potential of your business you will need an overall strategy including a Business Plan for Contractors

-

And of course Cheap Bookkeeping is the one area where short term savings is overwhelmed by making bad decisions based upon inaccurate QuickBooks reports

Type IV - Trade Contractors Plumbers, Electricians, HVAC, Flooring, Sheetrock, Painters, Landscapers and others.

-

You use QuickBooks to track all the costs and generate Simple Invoices which can then be input into QuickBooks Premier Contractor Edition

-

Your QuickBooks setup Chart of Accounts is usually focused Goods Sold Accounts (COGS) to allocate project costs

-

You will need to pay close attention to the Five Key Performance Indicators (KPI) to monitor the financial health of the business because your sales cycle is so short

-

You will need QuickBooks setup to have between 500 to 2,500 Items to track all the costs of the construction process from beginning to end

-

This is the fourth most difficult QuickBooks setup the Premier Contractor Edition to because there is a mix of Direct, Indirect, COGS accounts

-

You day to day input is also the third most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

Our experience has been your group generates the most stable income and you are not as sensitive to the ups and downs of the new construction market

-

In order to reach their full potential of your Trade Construction Business you will need an overall strategy including a Business Plan for Contractors

-

And of course Cheap Bookkeeping is the one area where short term savings is overwhelmed by making bad decisions based upon inaccurate QuickBooks reports

Type V - Service And Repair Companies like drain cleaners, emergency service electricians etc.

-

You use QuickBooks to track all the costs and generate Simple Invoices which can then be input into QuickBooks Premier Contractor Edition

-

Your QuickBooks setup Chart of Accounts is usually focused Goods Sold Accounts (COGS) to allocate project costs

-

You will need to closely monitor the daily changes in the Five Key Performance Indicators (KPI) to understand the financial health of your business

-

You will need QuickBooks setup to have between 500 to 2,500 Items to properly track all the costs of the construction process from beginning to end

-

This is the fourth most difficult QuickBooks Premier Contractor Edition to setup because there is a mix of Direct, Indirect, COGS accounts

-

The day to day input is also the third most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

Our experience has been your generates a very stable income because you are not as sensitive to the ups and downs of the new construction market

-

In order to reach your full business potential you need an strategy including a Business Plan for Contractors

-

And of course Cheap Bookkeeping is the one area where short term savings is overwhelmed by making bad decisions based upon inaccurate QuickBooks reports

Can I access QuickBooks desktop version securely in the cloud?

Yes we outsource to an Intuit approved commercial hosting environment so we could offer our clients all of the benefits of the full desktop version of QuickBooks accessible online 24/7 and it has been a huge success!

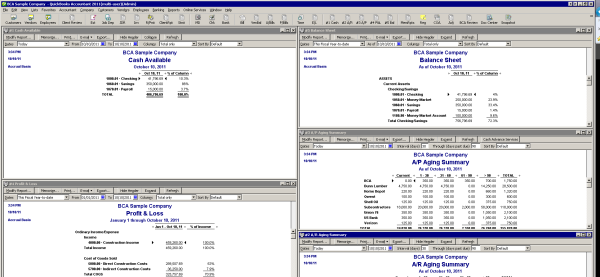

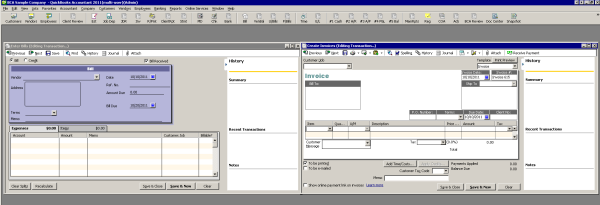

The Screenshots Below Were Taken In Our Lynnwood Washington Office

QuickBooks Is 1,000+ Miles Away Running On High-Speed Servers

Tucked Securely In A Building With Armed Guards

With Highly Skilled Technicians Maintaining It

All QuickBooks Files Are Backed Up Every Night On A Secured Server

Access Windows QuickBooks Desktop Version From PC or Mac

English Speaking, U.S. Based Technicians Maintain The Server

QuickBooks Software Updates Are Automatically Applied

We Provide Your QuickBooks Maintenance And Support

Frequently Asked Questions About It Click Here

Consulting Services For Contractors Answers

What is M.A.P. and how can it help me and my Contracting Company?

Most contractors are skilled technicians who learned their trade craft in an apprenticeship program, by experience or a combination of these methods. Over a course of time they developed a Paradigm, Mindset, Understanding, whatever word makes the most sense to you about how construction companies operate based upon their experiences.

In their experience production, getting work done is the most important part of the business because that is what they always did as an employee.

Since all learning is based upon connecting new things to things we already understand most contractors fall into a trap of only knowing what they know and not knowing what they don't know.

Learning to own and operate a successful construction company is very similar to learning a construction trade. There are only two ways to do it. Self-taught and learning from someone who is already mastered the skill.

Self-taught means making a lot of the same mistakes over and over and it takes a long time. Learning from a master is much faster and in the end allows the student the opportunity to go beyond the teachings of the master and have an even greater success.

In the best case scenario the student becomes a master and then continues the relationship with their master as colleagues and both people form what Napoleon Hill referred to as a Master Mind and together the two of them become even more skilled than they would if the continued working independently.

Taken to the next level more masters are invited to become a part of the Master Mind Group and the net result is the Rising Tide Raises All Ships and everyone achieves more individual wealth in money, friendships and long term lasting relationships than anyone could have possibly imagined.

Let me ask you some questions and let you decide if M.A.P. is something you may be interested in discovering more about it.

Are You Experiencing Any Of These “Symptoms” In Your Company?

▪ Totally overwhelmed by construction accounting and bookkeeping

▪ Confused about how to enter transactions into QuickBooks or whatever accounting system you are using

▪ Anxious about Quarterly Payroll Tax Returns / Sales Tax Returns / Workers Comp Tax Returns

▪ Frustrated with your accountant because they do not understand how construction works

▪ Unsure about whether to hire a bookkeeper or a bookkeeping services firm

▪ Baffled by webinars for QuickBooks setup that don't apply to construction

▪ Baffled by webinars on how to setup QuickBooks for your contracting company

▪ And then How to Systematize it all into a contracting company that runs smoothly without you having to constantly make decisions and solve problems

You’re wondering, “Will I EVER figure this out and finally crack the code to my financial freedom?”

I’m here to tell you YES! Click Here To Sign up for your Complimentary CLARITY Strategy Session

It’s your time and it’s your time to Truly Shine and Create Your Ideal Contracting Company.

Click Here To Sign up for your Complimentary CLARITY Strategy Session with Sharie to assist you in focusing your energy and finding out the best path to success for your Contracting Company.

Business Plan For My Contracting Company That Is Fast, Easy, Inexpensive And Web Based

Do you know of a contracting company that runs smoother than yours? They have the same challenges you do:

- Getting enough qualified leads to bid on and winning enough of them at a price that is profitable

- Finding employees who will arrive on time, do the work and not steal time, materials or customer

- Having enough cash to pay the bills before the end of the month and cash left over for the owner

Until now when a contractor like you wanted to put together a formal Business Plan it was more painful than a letting a dentist work on your teeth without using any painkiller! We found the answer. A simple financial forecasting tool that links to your Contractors QuickBooks file, does most of the work for you, it's cloud based, links to QuickBooks, updates automatically and it's Painless! Click Here For More...

Xero Accounting Online For Contractors Answers

Do you support Xero Accounting Online For Construction?

Yes we do!

Xero Accounting Online works best if you:

-

Need To Get Paid Faster And Easier

-

Have Simple Jobs You Invoice Individually

-

Need To Invoice Customers At The Job-site

-

Need Key Performance Indicator Financial Reports

-

Want Professional Construction Accounting At Lower Costs

Xero Accounting Online saves time in data entry which means we can offer Xero Accounting Online outsourced contractors bookkeeping services at a substantial savings over QuickBooks outsourced contractors bookkeeping services and provide more in-depth financial reporting with some of the reports being updated within seconds of when the transactions are received.

For more about it click on Xero Accounting Online

Do you repair Xero Accounting Online for Construction?

Yes we do. The cost of properly setting your books up and maintaining them is far cheaper and more effective than having your CPA fix and correct it during tax season. In addition, the benefits of having accurate and useful reporting during the year can help you make better and more informed decisions in all aspects of running your construction company.

We encourage you to take advantage of our Free One Hour Consultation and learn what the precise costs for your construction company would be.

Do you setup Xero Accounting Online for construction?

Yes we offer custom Xero Accounting Online setup designed for all different types of construction including commercial, residential, spec home builders and service / repair contractors. Xero Accounting Online does not offer Job Costing Reports, just QuickBooks.

Bill.Com Answers

Do you support Bill.Com for construction contractors?

Yes, we have Bill.Com certified specialists and Bill.Com Guru's on staff.

TSheets.Com Answers

Do you support TSheets for construction?

Yes we do! Tsheets is a great program for tracking time to each construction jobs and specific tasks or Schedule of Values on each job. For example if you are remodeling a house and want to track the time spent on demolition, framing, finish and clean-up. We can customize your QuickBooks setup to do that and more! We are Certified ProAdvisors For TSheets.com and we specialize in construction contractors.

Do you setup TSheets.com for construction contractors?

Yes we do! We specialize in construction accounting and offer outsourced contractors bookkeeping services.

We have a special arrangement with TSheets for a FREE 14 day trial click on the button below

Construction Accounting Is Used In Mobile Environments - Which means having a contractors bookkeeping services system that can track the costs that contractors incur related to doing custom work in a strictly mobilization environment. Some of the costs include travel time, mobilization (packing the tools, equipment, labor and material at their warehouse, delivering everything to the job and unpacking it) before starting the work and then demobilization (reversing the entire process when the job is finished).

Construction Accounting Is Built Upon Regular Accounting and shares the same basic financial reports for operating and growing a business and preparing annual tax returns and some very rudimentary management decisions. Construction accounting adds many complex layers of reporting mechanisms to show the contractor where their best customer are within psychographic and geographic market segmentation boundaries.

Does TSheets work with smartphones and iPhones?

Yes it does! For all your field construction employee time tracking needs, TSheets is a worthwhile option and travel companion. It has an easy–to–use graphical interface and with the simple touch of a button, employees can easily clock in, clock out, change tasks, and track GPS coordinates in real time. Online or offline. The video below explains it best:

Does TSheets link to QuickBooks?Yes it does and it is one of the few programs that links to QuickBooks without causing major problems. A lot of programs claim to link to QuickBooks and then act like a predatory software by changing the underlying transactions in a way that can cause a lot of damage and cost many thousands of dollars to repair. We are very careful about recommending any software that links to QuickBooks and only after we have thoroughly tested it.

TSheets can be a rather simple setup for most industries except construction. If you have a construction company there are a lot of variables to consider click here for more information.

Will TSheets Help With QuickBooks Job Costing Reports?

Yes it does because one of the biggest pain points is getting field construction workers to properly fill out their time card with all of the information your contractors bookkeeping services needs to allocate time to each job and task. TSheets can be used on an iPhone, smartphone, tablet, desktop PC and most web enabled devices.

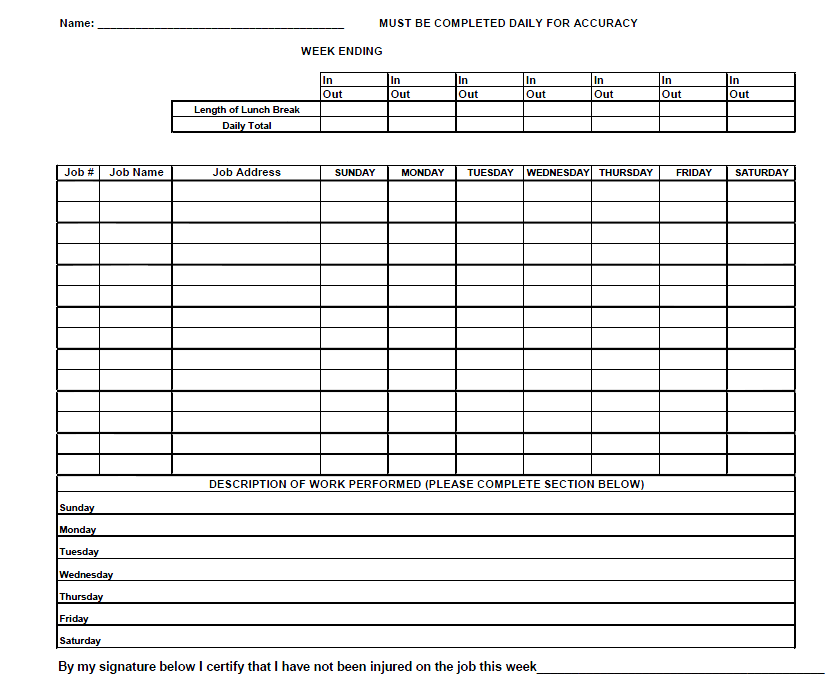

The old way of filling out a paper timecard and getting it to your contractors bookkeeping services was good for its time; however it costs your contracting company a lot of time and money that drained profit dollars from the bottom line at an alarming rate!

The average contractor's construction worker spends three minutes a day or fifteen minutes a week filling out a paper time card at a cost to your construction company of $8.91 ($35.64 per hour X 0.25)

It takes roughly ten minutes for bookkeeper to read, interpret and input each construction worker's time card into QuickBooks or Xero Accounting Online and file the paper time card.

Which means the cost per construction worker = $6.32 ($25.29 per hour X 0.25) and who knows how accurate the Job Costing Reports are?

Your Contractor Company is spending roughly $15.23 for each construction worker's paper time card! Is it any wonder your contractor company feels like a pipe for money to flow through without you being able to keep hardly any of it for you and your family?

We provide outsourced contractors bookkeeping services to construction companies just like yours all across the U.S.A. and continually find new and innovative ways to help them keep more money in their pockets to operate and grow their companies by finding ways to cut costs and streamline their construction accounting operations.

Three Construction Employees X $15.23 A Week X 52 Weeks A Year = $792.09 To The Bottom Line

This is just one example of how Fast Easy Accounting is helping construction company owners just put more money in the bank to operate and grow their companies. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you. Stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com

Profitable Construction - Companies have known about the value of outsourced bookkeeping services for a long time and now you know about it too!

We Scan Your Receipts And Invoices link them to Xero transactions where it is appropriate and give you back a CPA-ready packet for your tax return and we provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Construction Accounting Experts Specializing In Construction Bookkeeping Services For Contractors All Across The USA Including Alaska And Hawaii

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+

Our Co-Founder:

![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.