Marginal Revenue Vs. Marginal Cost

Every Day You Are - Presented With ways to spend your hard earned money and the key strategy is to put your money to work where it will earn you more money.

Some Are Worthwhile - Most of them are not. The answer is to have a system where you can quickly and easily determine which opportunities to pursue.

We Have Many Financial - Tools to help our clients make intelligent informed decisions on which opportunities to accept and which ones to reject.

A Few Scenarios:

-

Simple one-time investment

-

Large purchases with a down payment and subsequent monthly payments

-

Initial purchases followed by monthly or yearly maintenance payments

-

Present value calculations

-

Internal Rate Of Return (IIR)

-

Discounted cash flows

-

And several more

Our Clients - Need to provide three bits of information and we generate the report for them:

-

The cost (exact or rough estimate / whatever they have)

-

How long they expect the tool / equipment will last (weeks / months /years, whatever they have)

-

How much time it will save (minutes / hours / days, whatever they have)

From Three Bits - Of information and some reports we generate from their QuickBooks we generate the report for our construction business owner client a simple one page summary report they can use to make an intelligent informed decision.

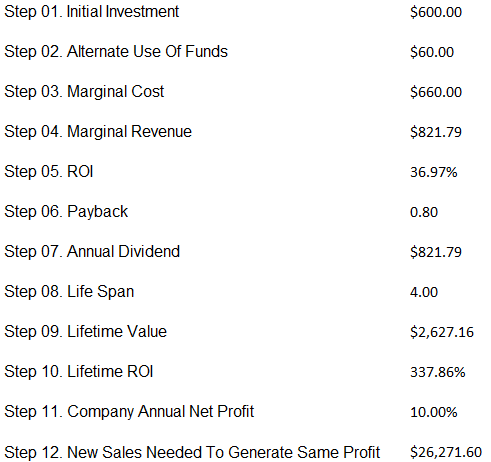

Shown Below - Is a very simple formula to give you some insights on investing in a one-time office equipment upgrade. The principle applies just as easily with field tools and equipment using field labor cost calculations.

One-Time Investment:

Step 01. Initial Investment - Projected cost of the opportunity

Step 02. Alternate Use Of Funds - Projected loss of interest or cost of borrowing initial investment

Step 03. Marginal Cost - Projected total Initial Investment plus Alternate Use Of Funds

Step 04. Marginal Revenue - Projected NEW revenue or savings from the opportunity

Step 05. ROI - Projected Return On Investment as a percentage

Step 06. Payback - Projected number of years for the opportunity to payback the Marginal Cost

Step 07. Annual Dividend - Projected NEW revenue or savings each year

Step 08. Life Span - Projected number of years the company will generate dividends

Step 09. Lifetime Value - Projected lifetime Value = (Annual Dividend X Life Span)

Step 10. Lifetime ROI - Projected lifetime Return On Investment as a percentage

Step 11. Construction Company - Annual profit as a percentage

Step 12. New Sales - Needed to generate same profit

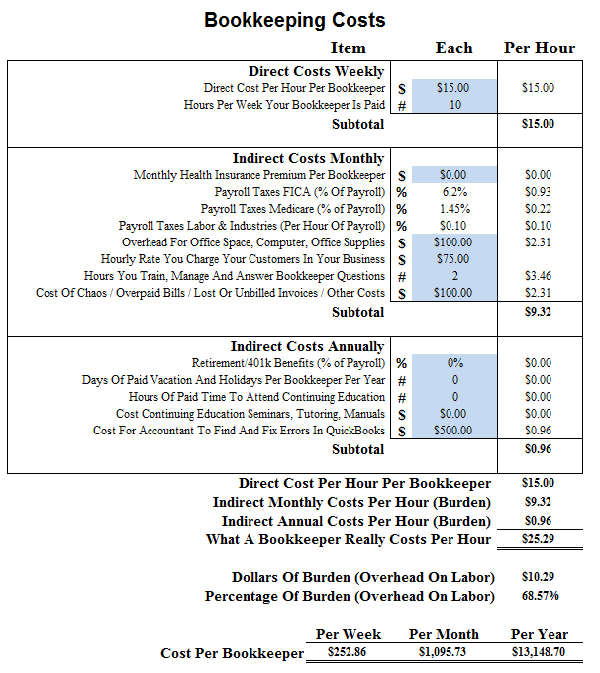

Bookkeeping Example:

The Problem

-

Bookkeeper has one 19" RGB monitor on the desk

-

Hard to see numbers which causes eye strain

-

Bookkeeper is wasting 30 minutes a day due to poor equipment

The Solution

Invest In Dual 27" DVI monitors for your bookkeeper's computer at a rough cost of $600.00

-

Bookkeeper has two 27" DVI monitors on the desk

-

Numbers has no eye strain

-

Bookkeeper is not wasting time

Increase Sales Or Reduce Costs - The two main drivers of profit. Best practices from successful construction companies are to do both. The key is a thorough analysis on a case-by-case basis for each opportunity.

The Example Shown Above - Should take about fifteen minutes if your QuickBooks is properly setup and maintained so that it generates accurate useful reports.

If Your QuickBooks - Is not generating accurate reports contact us immediately because most business failures can be traced back to a lack of Key Performance Reports and bad bookkeeping.

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+