How Do Bad Bookkeepers Train Their Boss? Like An Organ Grinder Trains A Monkey! Not all in-house construction bookkeepers are rotten. It seems to me the 80-20 rule applies here and only 80% of them are rotten. Yes, I know that sounds a bit harsh please understand it comes from over thirty years of experience in the construction industry both as a contractor, a construction accountant and profit and growth coach for a few select construction company owners. I have been there, done that, got the T-Shirt, the tattoo and sang a song about it.

Even as a construction accountant operating a plumbing service and repair company with seven trucks and over twenty employees I never ceased to be amazed at how many so-called "bookkeepers" would apply for a position and within a few short minutes of asking some key questions, the truth which is four levels deep, would reveal itself, and I knew they were rotten to the core. We are no longer in construction having decided to focus 100% on construction accounting since early 2000.

I could easily identify several psychological issues that I knew we did not even want to deal with. The idea they would be bold enough to apply for a position knowing I would see right through them was astounding. After a while I noticed a pattern of phrases that kept being repeated and I have put a select few choice ones on the Bad Bookkeeper page and if you want more in-depth understanding click on the button below:

Is This Your Construction Bookkeeping Services Desk? One of the biggest challenges construction company owners have with an in-house bookkeeper is training them to work for your best interest, not theirs, and deliver consistent results and the reports you can trust day after day, year after year.

Having been involved with construction and construction accounting and bookkeeping for over thirty years I have seen a consistent pattern repeated over and over that will turn an ordinary decent, pleasant bookkeepers into a disheveled, broken, mean, nasty, arrogant troll, and that's a good day when the sun is shining and the birds are singing!

Here Is How It Happens:

That's when the first of several unpleasant surprises happens; the pop quiz. QuickBooks screens start popping up and asking questions! Nobody said anything about a test or an exam and panic begins to take hold. The kind of panic you get from driving down a twisting winding mountain road at midnight and discovering the car you're driving has no brakes, and the headlights just went dim, and now you're playing bumper cars in the dark!

The bookkeeper thinks "don't screw this up because I can't afford to lose this job!" The questions keep coming like a raging river so in an attempt to put the responsibility on someone else the bookkeeper asks the contractor for help and is told: "I don't know, you're the bookkeeper go figure it out, I'm busy!"

The reference book did not help although there were some interesting notes written in the margins by the embezzler about how to cheat the company and the bookkeeper thinks it could make for some good reading later if needed.

Luckily QuickBooks has a guided tour of QuickBooks setup; unfortunately, it was the product of a committee and as everyone knows a camel is a horse put together by a committee!

The bookkeeper charges forward taking all the default answers suggested by QuickBooks and in just over two hours QuickBooks is setup horribly wrong, and so far it only cost the contractor of $25.29 per hour or $50.58 (click here for a sample fully burdened bookkeeper labor cost)

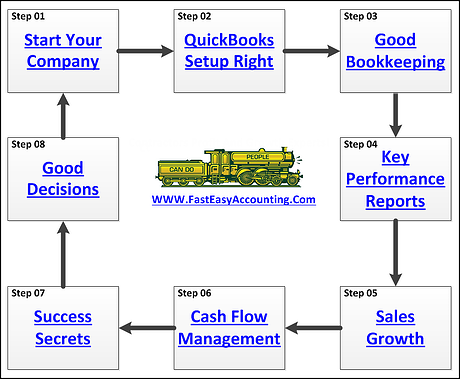

QuickBooks Setup QuickBooks Version is the most critical part of all because it is the foundation upon which your entire financial system is built. Put the wrong foundation under your business and it will not matter who is doing the bookkeeping because it will always be a mess and you will never get the reports you really need in order to operate and grow your business profitably.

Your Board Of Advisors - Will be very unhappy with your financial reports and especially your lenders. However, they are not likely to say much other than "NO"

Contractors Who Do Not Earn a lot of money see bookkeeping as overhead which costs money and therefore is a drain on profits so they get a cheap computer, tiny monitor, garbage printer, tiny desk and broken down chair that even the dog would not sit in and tell the bookkeeper this is all the company can afford.

In an effort to get their money's worth the contractor assigns all kinds of additional tasks to the bookkeeper like running business and personal errands, delivering materials, supplis, and paperwork to the job site, make coffee, answer the phones, take out the trash and clean the bathroom. Anything and everything to get "value" out of the time and money that is being wasted on bookkeeping.

Contractors can miss a lot of deadlines but miss a payroll and they are out of business. The day that happens your staff is looking for a new job no matter what they tell you. The contractor gets angry and makes deep noises from the chest sound like important messages from the brain and blames the bookkeeper for the missed payroll.

What has now evolved into The Incompetent Bookkeeper will respond with something like: "The time cards never arrived so I could not process payroll!" The contractor simply responds with something like: "You should have figured out how to get them even if it meant using your car, your gas, your personal time and have gone to the job site and got them, it's your fault! I depended on you to do your job, and you let me down!"

This is where the ordinary decent, pleasant bookkeeper starts growing an attitude thinking you don't understand how difficult bookkeeping is with a program like QuickBooks that is all screwed up and won't work right! Getting anything done in QuickBooks is a pain, a big fat royal pain, let alone all the other stuff the contractor wants to be done.

The bookkeeper thinks you don't know or care because you hired them to take care of the paperwork and that is exactly what you did because in business you produce reasons or results and reasons don't count.

Next, your vendors and suppliers don't get paid on time or worse yet you miss the 2% discount if paid by the 10th which in effect means you are paying 36% annual interest rate penalty and when you ask why the bookkeeper says they didn't have enough time to get the bills into QuickBooks.

This starts another round of talks about how you work 10 to 12 hours a day if that what it takes to get the job done and if the bookkeeper really cared they would do the same and only get paid for 8 hours.

Next, the payroll tax returns, sales tax returns, labor and industries tax returns, business and occupation tax returns, city licenses and liability insurance audits start slipping, and the fines and penalties add up.

And then bookkeeper starts testing the limits of your tolerance by coming in a few minutes late and leaving a few minutes early. Talking on their cell phone whenever they please. When you ask for a report, they say: "I will get to it later" or "QuickBooks will not do that" or one of my favorites: "Can't you see I'm busy?"

If you choose to fight, and demand the report the bookkeeper may work a little harder to get it done or they may do what the cook in some restaurants do when you send a meal back to be "fixed", they get even. Instead of spitting in your food the bookkeeper will start taking shortcuts like using Journal Entries to input credit card charges which totally destroys Job Costing Reports.

If you choose replacement, you can hire another in-house bookkeeper and repeat the process, or you can save time, money and aggravation by outsourcing to a competent Construction Bookkeeping Service . The choice is yours just think about it before you allow bad bookkeepers to drive you insane!

Let's look at an example of what the incompetent bookkeeper costs that is known and knowable in the first year.

QuickBooks Setup horribly wrong = $50.58

Payroll for bookkeeping should have been two hours a day = $6,828.30

Overpaying by two hours a day for bookkeeping = $6,828.30

Lost productivity from bad QuickBooks setup 30 minutes a day = $3,410.10

(click here for sample of what is 10 minutes costing your construction company)

2% on lost discounts X $100,000 in purchases = $2,000.00

Late Quarterly Tax Reports $25,000 X 25% Penalty = $6,250.00

Estimated Total = $25,367.28

Estimated Savings 40% By Outsourcing Bookkeeping = $10,146.91

Does not include overpaying income tax, lost productivity due to stress and a number of other unknowns.

Outsourcing doesn't cost; it pays that is why the oil change stores are so popular

Outsourcing your construction bookkeeping to us is even better because all construction bookkeeping services are done in our office in Lynnwood Washington by skilled construction bookkeepers and construction accountants.

When You Become A Client reports hidden in your QuickBooks S.W.O.T. Analysis Strategic Roadmap

If You Are A Contractor You Deserve To Be Wealthy Because You Bring Value To Other People's Lives! This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

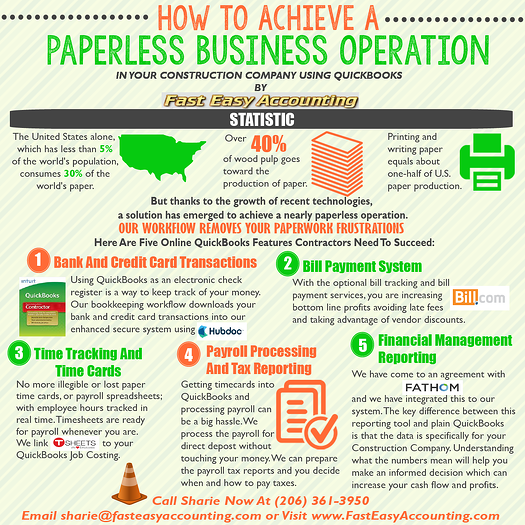

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services

Thinking About Outsourcing Your Contractors Bookkeeping Services? Click On The Button Below To Download A Free Guide

Need Help Now? Call Sharie 206-361-3950

We Are Construction Accounting Experts Specializing In Construction Bookkeeping Services For Contractors All Across The USA Including Alaska And Hawaii

Cloud Based QuickBooks Outsourced Bookkeeping Services For Contractors All Across The U.S.A. We are headquartered in Lynnwood, Washington State, USA. We work remotely to meet your accounting and bookkeeping needs with QuickBooks and Xero Accounting Online whichever is most appropriate for your situation. We can perform a QuickBooks Setup,QuickBooks cleanup, customize your invoices, process payroll and generate QuickBooks financial reports. We Help “A Little or A Lot” depending on your needs including on-going bookkeeping services. Remote web based QuickBooks for contractors bookkeeping, accounting & quarterly tax reports. We specialize in contractors including general, specialty and trade contractors, home builders and commercial tenant improvement contractors. If you need help please call Sharie <span class="baec5a81-e4d6-4674-97f3-e9220f0136c1" style="white-space: nowrap;">206-361-3950<a title="Call: 206-361-3950" style="margin: 0px; border: currentColor; left: 0px; top: 0px; width: 16px; height: 16px; right: 0px; bottom: 0px; overflow: hidden; vertical-align: middle; float: none; display: inline; white-space: nowrap; position: static !important;" href="#"><img title="Call: 206-361-3950" style="margin: 0px; border: currentColor; left: 0px; top: 0px; width: 16px; height: 16px; right: 0px; bottom: 0px; overflow: hidden; vertical-align: middle; float: none; display: inline; white-space: nowrap; position: static !important;" src="data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAABAAAAAQCAYAAAAf8/9hAAAACXBIWXMAAA7EAAAOxAGVKw4bAAAAIGNIUk0AAHolAACAgwAA+f8AAIDpAAB1MAAA6mAAADqYAAAXb5JfxUYAAAKLSURBVHjadJPfS5NhFMe/21xvuhXRyJAZroiSrJnbRdT7vrAf5HBaK5RABmEEwQIvkpZ/QRcWXdSFw5soKaF0F7qZeLO13mGBDpQsf5CoxVKHOt0Pctp2uvEdrzG/V+c553w/54HnPDIiQiGpPMETABoB2AAYd9MRAMMAvGmX+RcAyAoBVJ7gZQDtABworH4AHWmX+bOMZdkjCoXiUzabvcAwzPSsob5p/VTNY9GcdpnxdmYZ9wJThSCtCr1e/4XjuNPd3d1KjUZzaGbI27ysqzGQoggAsLa1A7ehArrDxfDNr0oBlQB+wmKxbJFEL968SxoamsjkHaPU9l9piUo6A0RE1DG2QCWdASrpDAzJM5kMI8XecdjVxfEl+K9dxFgsgUvvR6HyBKHyBAEATyKLeGSsENuNcqk5kUjEGm7fzcYqr0ClVODl99+YXEvl6+c1amjVe+ahiGGYaUEQKnmeh91uL43rqheixjpdmzCL11er0PcjhrTLvMfUJsyKYUSeyWQ6enp6tgCgrKxsfbP8bB8AdE1G89cOReMAgOv+Cag8QXRNRkXAsDwcDr+am5tLCYKA3t7eo2dG+1vVK/MfpRPtA+MIReMYaKj+/xm9MiICx3EmpVL5wefzFavValis1u1vvHMkdfykCQC0kSGUTo+Ajmnx1dSC7IGD+UUCEYGIwLKsyWazrSeTSSIiMpnNf7Ttz5+ec96fr7/VnE0mk+QfHMzV3WjcKH/4rEr05QGFIA6HY4llWRLPRER+v3/HYrFMFQSIkNra2tVQKJSlfcSyLO0LECFWq3XF6XRGA4HAptTsdrsXeZ6fEHtl+31nAOA4rkUulz/I5XL63dQGgHEAN8Ph8AYA/BsAt4ube4GblQIAAAAASUVORK5CYII="></a></span> or sharie@FastEasyAccounting.com If you are considering hiring a contractors bookkeeping service go to http://www.fasteasyaccounting.com/contractors-bookkeeping-services-guide-for-quickbooks

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System Randal on Google+

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.